Debanking – Achieving Financial Liberation by Escaping the Traditional Banking System

In today’s world, many individuals are seeking alternatives to the traditional banking system. With increasing fees, lack of transparency, and limited control over our own finances, it’s no wonder that people are looking for a way to break free from the chains of traditional banks.

One such alternative that has been gaining traction is debanking. Debunking, or the process of removing oneself from the traditional banking system, offers a new path towards financial freedom. By embracing debanking, individuals can regain control over their money, reduce fees, and escape the often frustrating limitations imposed by traditional banks.

Debanking allows individuals to manage their finances in a way that aligns with their values and priorities. With debanking, you can choose to support financial institutions that have a positive impact on society, such as community banks or credit unions. You can also opt for digital banking platforms that offer greater transparency and fairer fees.

Moreover, debanking opens up a world of possibilities when it comes to financial opportunities. Instead of being tied to a traditional bank, debanking allows individuals to explore innovative solutions such as peer-to-peer lending, crowdfunding, and digital currencies. These new avenues can provide individuals with greater control over their financial future and the ability to support projects and causes that resonate with them.

Whether you’re frustrated with the limitations of traditional banks or simply seeking a more flexible and empowering financial solution, debanking can help you find the freedom you’re looking for. By embracing this alternative approach, you can take charge of your finances, support institutions that share your values, and unlock a new world of opportunities. So, are you ready to break away from the traditional banking system and discover the wealth of possibilities that debanking has to offer?

Understanding the Traditional Banking System

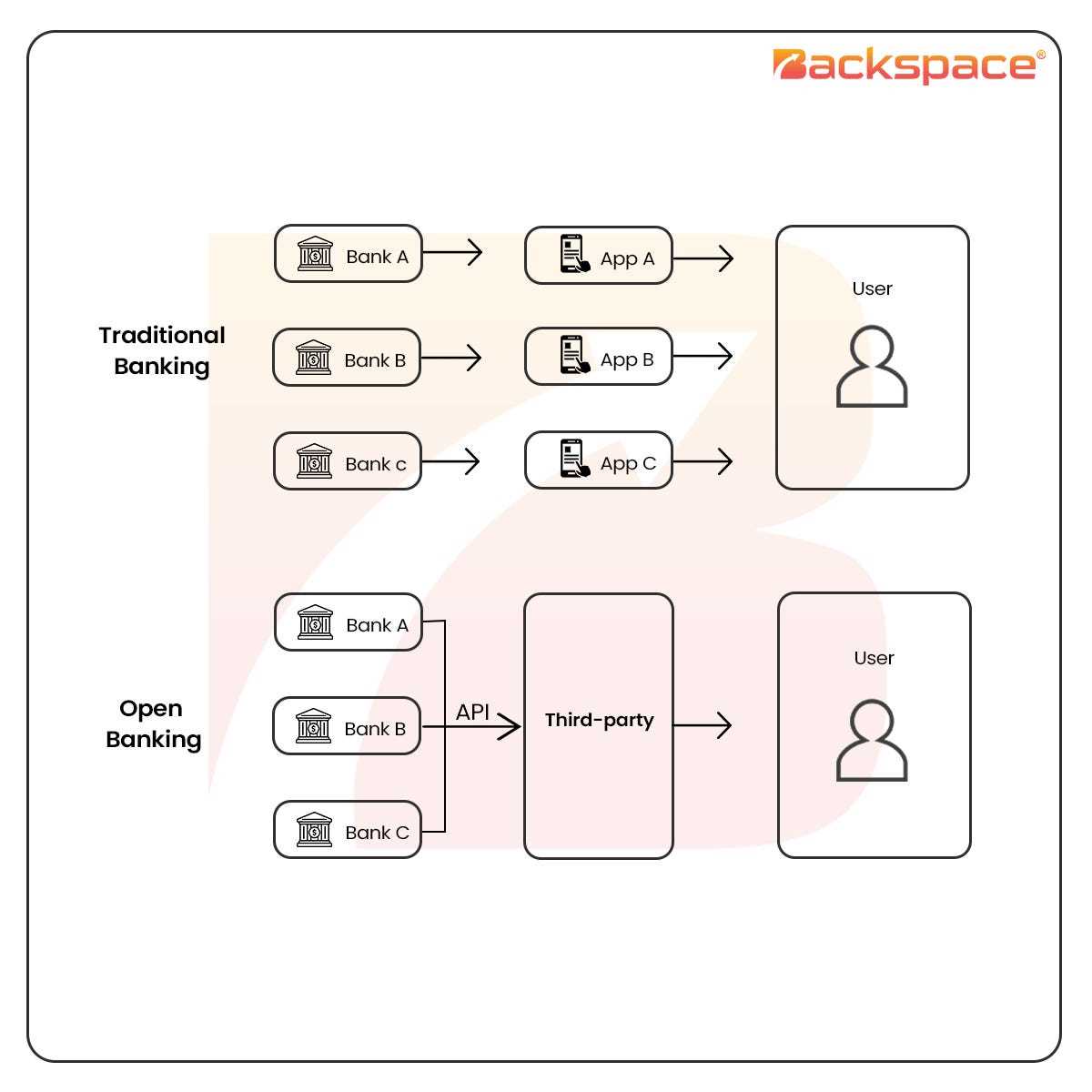

Traditional banking has long been the primary method for individuals and businesses to manage their finances. However, as technology has advanced and alternative financial systems have emerged, many people are seeking ways to break away from the limitations and fees associated with traditional banks.

Traditional banks operate on a centralized system, where they act as a middleman in financial transactions, holding and managing customers’ money. They offer various services, including savings accounts, checking accounts, loans, and credit cards. Banks also provide customer support, financial planning services, and investment opportunities.

One of the main drawbacks of the traditional banking system is its lack of transparency and control. Customers often face hidden fees, long processing times, and limited access to their funds. Additionally, banks have the authority to freeze or seize accounts under certain circumstances, which can be disruptive and frustrating for customers.

Moreover, traditional banks require customers to provide extensive documentation for account opening, which can be a time-consuming and invasive process. Banks also have strict eligibility criteria for loans and credit cards, making it difficult for some individuals and small businesses to access financial services.

As a response to these challenges, alternative financial systems like debanks have emerged, leveraging blockchain technology to provide decentralized and more transparent financial services. They allow individuals to have complete control over their funds, eliminating the need for intermediaries and reducing fees.

Advantages of Debanks:

- Decentralization: Debanks operate on a decentralized network, which means that transactions are verified by a network of computers rather than a central authority. This increases security and reduces the risk of fraud.

- Transparency: Debanks use blockchain technology to record and store transactions, providing a transparent and immutable ledger of all financial activities. This allows users to verify their transactions and ensures that the system is fair and trustworthy.

- Accessibility: Debanks have fewer eligibility requirements and lower entry barriers, making financial services more accessible to individuals and businesses who are traditionally underserved by the banking system.

- Lower Fees: Debanks often have lower fees compared to traditional banks, as they eliminate the need for intermediaries and streamline processes. This can result in significant cost savings for users.

In conclusion, understanding the traditional banking system is essential for those looking to break away from its limitations and explore alternative financial systems. Debanks offer a new approach to financial services, empowering individuals with greater control, transparency, and accessibility.

Challenges of the Traditional Banking System

The traditional banking system has long been the primary method for individuals and businesses to access and manage their finances. However, this system is not without its challenges. This section will explore some of the key challenges that the traditional banking system faces.

1. High Fees

One of the major challenges of the traditional banking system is the high fees that are often associated with various services. Whether it’s transaction fees, account maintenance fees, or fees for accessing certain financial products, these costs can quickly add up and eat into the funds of individuals and businesses. This can be especially burdensome for individuals with low incomes or those living paycheck to paycheck.

2. Limited Accessibility

Another challenge is the limited accessibility of traditional banks, particularly in rural areas or areas with low-income populations. Many individuals may have to travel long distances to access a bank branch, which can be inconvenient and costly. This lack of accessibility makes it difficult for some individuals to access the financial services they need to manage their money effectively.

3. Lack of Transparency

The traditional banking system often lacks transparency, making it difficult for customers to fully understand the terms and conditions of their accounts or the fees associated with various services. This lack of transparency can lead to misunderstandings and unexpected costs for customers, eroding trust in the banking system.

4. Slow and Inefficient Processes

The traditional banking system is known for its slow and inefficient processes. From applying for a loan to transferring funds, these processes can be time-consuming and involve extensive paperwork. This can be frustrating for individuals and businesses who need quick access to their funds or who want to take advantage of time-sensitive opportunities.

Overall, while the traditional banking system has served as the backbone of the financial industry for many years, it is not without its challenges. These challenges have contributed to the rise of alternative banking methods, such as debanking, which offer greater freedom and flexibility for individuals and businesses seeking to break away from the traditional system.

Debanking: What is it?

Debanking refers to the process of voluntarily disconnecting oneself from the traditional banking system. It involves seeking alternatives to traditional banks for managing financial transactions and accessing financial services. The term “debanking” has gained traction in recent years as individuals and businesses look for ways to break free from the limitations and constraints imposed by traditional banks.

In a traditional banking system, individuals and businesses rely heavily on banks to store their money, make transactions, and access credit and loans. However, traditional banks often come with drawbacks such as high fees, slow transaction times, and limited accessibility. Debanking offers an alternative approach that aims to empower individuals and businesses to take control of their finances and reduce reliance on traditional banks.

Why do people pursue debanking?

People pursue debanking for a variety of reasons. Some of the common motivations include:

- Reducing fees: Traditional banks often charge high fees for services such as wire transfers, ATM withdrawals, and account maintenance. By debanking, individuals can seek out alternative options that offer lower fees or fee-free services.

- Increasing financial privacy: Traditional banks collect and store a significant amount of personal and financial data. Debanking allows individuals to minimize their exposure to data breaches and unauthorized access by keeping their financial information decentralized.

- Accessing alternative financial services: Debanking opens up opportunities to access a range of alternative financial services that may not be offered by traditional banks. This includes decentralized finance (DeFi) platforms, peer-to-peer lending platforms, and digital currencies.

- Resisting censorship and control: Debanking can be seen as a way to resist censorship and control imposed by traditional banks and financial institutions. By decentralizing financial activities, individuals and businesses can operate outside the jurisdiction and influence of a single authority.

Challenges and considerations with debanking

While debanking offers numerous benefits, it is important to consider some of the challenges and potential drawbacks before making the transition. These include:

| Challenges | Considerations |

|---|---|

| Security risks | Debanking often involves interacting with digital and decentralized financial platforms, which can expose individuals to security risks such as hacking and scams. It is crucial to take appropriate precautions and educate oneself about the risks involved. |

| Regulatory limitations | Debanking may be subject to regulatory restrictions and limitations in certain jurisdictions. It is essential to understand and comply with the legal and regulatory requirements of the country or region in which one operates. |

| Limited adoption | While debanking is gaining momentum, it is still a relatively new concept and may have limited adoption and acceptance in mainstream society. This could potentially result in challenges such as limited merchant acceptance and difficulties in finding services that cater to debanking needs. |

Despite these challenges, debanking offers a pathway to greater financial freedom, flexibility, and control. It allows individuals and businesses to explore alternative options and make choices that align with their specific financial needs and goals.

The Benefits of Debanking

Debanking offers individuals and businesses the opportunity to break free from the traditional banking system and take control of their finances. By debanking, you can enjoy a range of benefits, including:

1. Independence and Freedom: When you debank, you no longer have to rely on financial institutions to manage your money. You have the freedom to choose where and how you want to store, transfer and invest your funds, giving you greater control over your financial decisions.

2. Lower Fees: Traditional banks are notorious for charging high fees for their services. By debanking, you can avoid or significantly reduce these fees, which can save you a substantial amount of money over time. Instead, you can choose alternative financial solutions that offer lower or even no fees.

3. Privacy and Security: Debanking can provide you with a higher level of privacy and security for your financial transactions. Traditional banks often require you to disclose personal and sensitive information, which can be vulnerable to security breaches. With debanking, you can safeguard your personal data and enjoy enhanced security measures.

4. Financial Inclusion: Many people, particularly those in underserved communities, struggle to access traditional banking services. Debanking can provide an alternative solution, allowing individuals to participate in the economy and access financial services that were previously unavailable to them. This can help promote financial inclusion and empower individuals and communities.

5. Flexibility and Innovation: Debanking allows you to explore and take advantage of innovative financial solutions that may not be available within the traditional banking system. With debanking, you can access a wide range of financial technologies, such as digital wallets, peer-to-peer lending platforms, and cryptocurrency exchanges, enabling you to adapt to changing financial landscapes and explore new opportunities.

Overall, debanking offers individuals and businesses the chance to break free from the limitations and constraints of the traditional banking system. It provides independence, lower fees, enhanced privacy and security, financial inclusion, and flexibility to navigate the ever-evolving world of finance.

Steps to Break Away from Traditional Banking

Breaking away from the traditional banking system may seem like a daunting task, but with the right steps, it is achievable. Here are the steps you can follow to find freedom with debanking:

|

Step 1: Research Alternative Banking Options |

|

Start by researching and exploring alternative banking options that align with your financial goals and values. Look into digital banks, credit unions, and other non-traditional financial institutions that offer services tailored to your needs. Compare their fees, features, and customer reviews to make an informed decision. |

|

Step 2: Open an Account with an Alternative Bank |

|

Once you have identified a suitable alternative bank, open an account with them. Follow their account opening process, which may include submitting identification documents and fulfilling other requirements. Make sure to transfer any funds or recurring payments from your traditional bank account to your new account. |

|

Step 3: Set Up Direct Deposits and Automatic Payments |

|

To ensure a smooth transition, set up direct deposits for your income and automatic payments for recurring bills. Update your employer with your new bank account information and transfer any automatic bill payments to your alternative bank account. This will help you maintain financial stability without relying on traditional banks. |

|

Step 4: Close Your Traditional Bank Account |

|

After successfully transitioning to an alternative bank, it’s time to close your traditional bank account. Contact your bank and follow their account closure process, which may involve withdrawing any remaining funds and completing necessary paperwork. Make sure to redirect any incoming payments and update your financial information with relevant institutions. |

|

Step 5: Monitor and Manage Your New Banking Relationship |

|

Once you have broken away from traditional banking, it’s important to regularly monitor and manage your new banking relationship. Stay updated on your account activities, review your statements, and take advantage of any digital tools or resources provided by your alternative bank. This will help you make the most of your new banking freedom. |

By following these steps, you can successfully break away from the traditional banking system and find financial freedom with debanking.

Choosing Alternative Financial Services

When looking to break away from the traditional banking system, there are a variety of alternative financial services to consider. These services can provide greater flexibility and convenience, as well as potentially lower fees. Here are some options to explore:

- Online-only banks: Many online-only banks offer a range of banking services without physical branches. They can provide lower fees and higher interest rates on savings accounts.

- Peer-to-peer lending platforms: These platforms connect borrowers and lenders directly, cutting out traditional banks. This can result in lower interest rates for borrowers and higher returns for lenders.

- Mobile payment apps: Mobile payment apps like Venmo and PayPal allow you to easily send and receive money using just your smartphone. These apps often have lower transaction fees compared to traditional banking services.

- Prepaid debit cards: Prepaid debit cards can be a good alternative to traditional checking accounts. They offer convenience and flexibility, with many options available that don’t require a credit check or traditional bank account.

- Cryptocurrency: Cryptocurrency, such as Bitcoin or Ethereum, offers a decentralized and digital alternative to traditional banking. While it is still a relatively new and volatile form of currency, it can provide an additional level of financial freedom.

When choosing alternative financial services, it’s important to consider your specific needs and goals. Research and compare different options to find the services that best fit your financial situation.

Exploring Mobile Banking Apps

With the rise of smartphones and the increasing popularity of mobile banking, it is now easier than ever to manage your money on the go. Mobile banking apps offer a convenient way to access your accounts, make payments, and track your expenses, all from the palm of your hand.

One of the key advantages of mobile banking apps is their accessibility. Whether you’re traveling, waiting in line, or simply prefer the convenience of managing your finances from your phone, mobile banking apps provide a flexible solution. With just a few simple taps, you can check your account balance, transfer funds, or pay bills, without the need for a computer or visiting a bank branch.

Furthermore, mobile banking apps are designed with security in mind. They often incorporate advanced encryption techniques to protect your personal and financial information. In addition, many apps offer additional security features such as fingerprint or facial recognition to ensure that only you can access your accounts.

Another advantage of mobile banking apps is their ability to provide real-time updates and notifications. You can receive instant alerts for account activity, such as receiving a deposit or a large transaction, helping you stay on top of your finances and quickly identify any unauthorized activity.

Mobile banking apps also offer a wide range of features and services. In addition to basic account management, many apps provide tools to help you budget, save, and track your spending. You can set budget goals, categorize your transactions, and view detailed reports to gain insights into your financial habits.

Finally, mobile banking apps often integrate with other financial apps and services, allowing you to streamline your financial life. You can link your banking app with apps for budgeting, investment tracking, or even peer-to-peer payments, providing a holistic view of your financial situation.

In conclusion, exploring mobile banking apps can open up new possibilities for managing your money conveniently and securely. From accessing your accounts on the go to receiving real-time updates and integrating with other financial tools, these apps offer a range of features to enhance your financial freedom and flexibility.

Embracing Cryptocurrency

In recent years, cryptocurrency has emerged as an innovative and decentralized digital currency that is quickly gaining popularity. It offers an alternative to traditional banking systems and provides individuals with a new way to manage their finances.

One of the main advantages of cryptocurrency is that it operates on a technology called blockchain, which ensures transparency, security, and privacy. Transactions carried out with cryptocurrency are recorded on a public ledger, ensuring that they are secure and cannot be tampered with. This decentralized nature of cryptocurrency means that it is not controlled by any central authority, giving individuals more control over their financial transactions.

The Benefits of Cryptocurrency

There are several benefits to embracing cryptocurrency:

- Financial Freedom: Cryptocurrency allows individuals to have full control over their funds without relying on traditional banking systems. This means that you can send and receive money without the need for a bank account and without going through lengthy processes or paying high fees.

- Global Accessibility: Cryptocurrency transcends geographic boundaries, allowing transactions to be conducted globally. This is particularly beneficial for those who need to send money internationally, as it eliminates the need for costly currency conversions and slow transfer times.

- Security and Privacy: Cryptocurrency transactions are highly secure and offer enhanced privacy. When making a transaction, users utilize cryptographic techniques that ensure the authenticity and integrity of the transaction. Additionally, unlike traditional financial systems, cryptocurrency does not require you to share personal information, maintaining your privacy.

Getting Started with Cryptocurrency

If you’re interested in embracing cryptocurrency, here are some steps to get started:

- Educate Yourself: Start by learning about different cryptocurrencies and how they work. Familiarize yourself with the technology, terminology, and potential risks and rewards associated with cryptocurrency.

- Choose a Wallet: Select a digital wallet that allows you to securely store and manage your cryptocurrencies. There are various types of wallets available, including hardware wallets, software wallets, and online wallets.

- Acquire Cryptocurrency: Purchase cryptocurrency from a reputable exchange platform. Conduct thorough research to find a reliable platform that suits your needs in terms of security, ease of use, and available cryptocurrencies.

- Start Transacting: You can now start using your cryptocurrency to make purchases, send money, or invest. Look for businesses that accept cryptocurrency as a form of payment, and always ensure that you are using secure and reputable platforms.

By embracing cryptocurrency, individuals can take advantage of the benefits it offers and break away from the limitations of traditional banking systems. It provides a new level of financial freedom, accessibility, and security, making it an attractive option for those seeking alternative ways to manage their finances.

Debanking: A Path to Financial Freedom

Are you tired of being trapped in the traditional banking system? Are you looking for an alternative that offers more freedom and control over your finances? If so, debanking might be the solution you’ve been searching for.

Debanking is the process of breaking away from traditional banks and financial institutions in favor of more independent financial solutions. It involves moving away from traditional banking services such as checking accounts, credit cards, and loans, and instead embracing alternatives that offer greater autonomy and liberation.

The Benefits of Debanking

There are many compelling reasons why individuals are choosing to debank and pursue financial freedom:

- Freedom from fees: Traditional banks often charge hefty fees for various services, such as monthly maintenance fees, overdraft fees, and transaction fees. By debanking, individuals can avoid these unnecessary expenses and save money in the process.

- Greater privacy: Debanking allows individuals to maintain greater privacy over their financial transactions. Without the need for traditional bank accounts, individuals can reduce the amount of personal information they must provide to financial institutions and minimize the risk of data breaches.

- Investment control: Debanking empowers individuals to have more control over their own investments. Instead of relying on banks to manage their funds, individuals can explore alternative investment opportunities and make choices that align with their own financial goals and values.

How to Start Debanking

If you’re interested in embarking on the path to financial freedom through debanking, here are some steps to get you started:

- Evaluate your current financial situation: Take a close look at your current banking arrangements and identify the fees you’re paying and any other limitations you may face. This will help you determine which aspects of traditional banking you want to move away from.

- Research alternative financial solutions: Explore the growing number of financial alternatives available outside of traditional banking. This can include online-only banks, decentralized digital currencies, and peer-to-peer lending platforms. Look for options that align with your financial goals and values.

- Set up new accounts: Once you have identified the alternatives that work best for you, begin the process of setting up new accounts and transferring your funds. Be sure to close your traditional bank accounts to fully embrace your debanking journey.

- Monitor and adjust: As you transition to a debanking lifestyle, it’s important to regularly monitor your new accounts and adjust your financial strategies as needed. Stay informed about emerging financial technologies and opportunities that can further enhance your financial freedom.

Breaking away from the traditional banking system and embracing debanking can be a powerful step towards achieving financial freedom. By evaluating your current financial situation, researching alternative solutions, and taking proactive steps towards a more independent financial future, you can pave your own path towards financial liberation.

Empowering Individuals and Businesses

In today’s fast-paced digital world, individuals and businesses are looking for more flexible and efficient solutions for their banking needs. Traditional banking systems often come with limitations and restrictions that can hamper financial growth and innovation. However, with the rise of debanking, individuals and businesses now have the opportunity to break away from these limitations and empower themselves with financial freedom.

Benefits of Debanking

By debanking, individuals and businesses can enjoy a range of benefits that were previously unavailable in the traditional banking system. These benefits include:

| 1. Enhanced Control | Debanking allows individuals and businesses to have more control over their financial transactions. With the ability to choose alternative banking solutions like cryptocurrencies and digital wallets, individuals and businesses can manage their funds and investments with greater autonomy. |

| 2. Lower Fees and Costs | Traditional banks often impose high fees and charges for various services. By debanking, individuals and businesses can reduce or eliminate these fees, allowing them to save more money and allocate it towards other financial goals or investment opportunities. |

| 3. Access to Unbanked Markets | Debanking opens up opportunities for individuals and businesses to access unbanked markets. With alternative banking solutions, individuals and businesses can reach customers who may not have access to traditional banking services, expanding their customer base and potential revenue. |

Debanking for Individuals

For individuals, debanking offers a way to bypass the limitations of traditional banking and take control of their personal finances. By utilizing alternative banking solutions, individuals can enjoy faster and more convenient transactions, access to a wider range of investment options, and increased privacy and security for their financial transactions.

Debanking for Businesses

For businesses, debanking can revolutionize the way they manage their finances. By embracing alternative banking solutions, businesses can streamline their payment processes, reduce costs associated with traditional banking, and operate more efficiently on a global scale. Additionally, debanking allows businesses to tap into emerging technologies and trends, such as blockchain and decentralized finance, which can provide new opportunities for growth and innovation.

In conclusion, debanking is a powerful tool that empowers both individuals and businesses. By breaking away from the traditional banking system, individuals and businesses can enjoy enhanced financial control, reduced costs, and access to untapped markets. Whether you are an individual looking for more financial freedom or a business seeking to optimize your financial operations, debanking can unlock a world of possibilities and help you achieve your goals.

FAQ:,

What is debanking?

Debanking is the process of breaking away from the traditional banking system and finding alternative financial solutions.

Why would someone choose debanking?

People may choose debanking to regain control over their finances, avoid high fees and hidden charges, and have more freedom and flexibility in their financial decisions.