Why Conducting a Debank Check on Your Wallet is Crucial – Login | DeBank | The Web3 Messenger & Best Web3 Portfolio

Why is debank

Why Conducting a Debank Check on Your Wallet is Crucial

When it comes to personal finance, it’s essential to stay proactive and informed. While most people focus on budgeting, saving, and investing, there’s one critical aspect that often gets overlooked – conducting a debunk check on your wallet. What does this mean? Well, it’s the process of debunking the myths and misconceptions surrounding money management that might be hindering your financial progress.

Many of us have grown up with certain beliefs about money that have been passed down from generation to generation. These beliefs might have seemed true at the time, but as the financial landscape evolves, they may no longer hold water. By conducting a debunk check, you’re challenging these long-held beliefs and separating fact from fiction.

One common myth that often needs debunking is the idea that having a high income automatically leads to financial success. While a high income certainly helps, it’s not the only factor that determines your financial well-being. Without proper financial planning, budgeting, and smart money management, even a six-figure salary can end up leaving you struggling to make ends meet.

Another misconception that needs debunking is the notion that debt is always bad. While it’s true that certain types of debt, such as high-interest credit card debt, can be detrimental to your financial health, not all types of debt are created equal. Mortgages, student loans, and business loans, when managed responsibly, can actually be tools for building wealth and achieving financial goals.

By conducting a debunk check on your wallet, you’re taking control of your financial future. It’s about challenging the conventional wisdom and seeking out the truth about money management. So, don’t be afraid to question long-held beliefs, seek out reliable financial information, and adapt your financial strategies accordingly. Your wallet will thank you.

The Significance of Verifying Your Wallet with a Debunk Check

As cryptocurrency continues to gain popularity, it’s crucial for individuals to take precautions and ensure the safety of their digital assets. One important step in protecting your funds is verifying your wallet with a debunk check. This process involves checking the authenticity and legitimacy of your wallet to avoid falling victim to scams or fraudulent activities.

Verifying your wallet with a debunk check is essential because:

1. Preventing Hacks and Theft

By conducting a debunk check on your wallet, you can detect any potential security vulnerabilities that could expose your funds to hackers and thieves. This includes checking for any suspicious or unauthorized transactions, reviewing the wallet’s encryption measures, and ensuring that the wallet provider is reputable and trustworthy.

2. Safeguarding Against Scams

There are numerous cryptocurrency scams out there, from fake wallet providers to Ponzi schemes and phishing attacks. Verifying your wallet with a debunk check can help you verify the legitimacy of the wallet provider and ensure that you are not falling into any scam traps. This involves researching the wallet provider, reading reviews and feedback from other users, and double-checking the wallet’s URL to avoid phishing attempts.

3. Ensuring Privacy and Anonymity

For those who value privacy and anonymity in their cryptocurrency transactions, conducting a debunk check on your wallet is crucial. This involves verifying that the wallet provider has strong privacy policies in place, such as using secure encryption methods and not collecting unnecessary personal information. By doing so, you can ensure that your identity and transactions remain confidential.

In conclusion, verifying your wallet with a debunk check is essential for protecting your digital assets in the world of cryptocurrency. It helps prevent hacks and theft, safeguards against scams, and ensures privacy and anonymity. By taking the necessary precautions and verifying the legitimacy of your wallet, you can enjoy a safer and more secure cryptocurrency experience.

Why Is a Debunk Check Necessary?

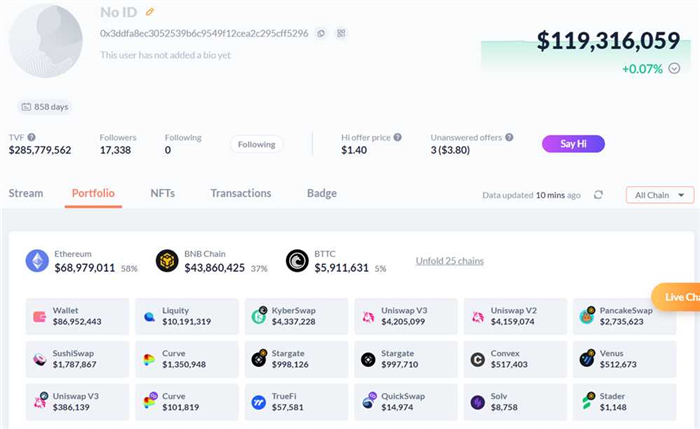

A debank check is an essential step in ensuring the security of your wallet. It is important to conduct regular debank checks to protect yourself from potential scams and fraudulent activities. By conducting a debank check, you can identify any unauthorized transactions, fraudulent charges, or suspicious activities that may have taken place in your wallet.

Furthermore, a debank check allows you to verify the accuracy of your financial records and ensure that your wallet is operating as expected. It enables you to review your transaction history and account balances, ensuring that there are no discrepancies or errors.

In addition, a debank check helps you identify any potential vulnerabilities or weaknesses in your wallet’s security measures. By regularly reviewing your wallet and its associated accounts, you can stay vigilant against any unauthorized access attempts or fraudulent activities.

Conducting a debank check also serves as a preventive measure. By regularly reviewing your wallet, you can identify and address any issues before they escalate into bigger problems. It allows you to take prompt action in case of any suspicious activities, thereby minimizing the potential financial loss and damage.

| Benefits of a Debunk Check: |

| 1. Ensures the security of your wallet |

| 2. Identifies unauthorized transactions and fraudulent charges |

| 3. Verifies the accuracy of your financial records |

| 4. Helps identify potential vulnerabilities in your wallet’s security |

| 5. Serves as a preventive measure against financial loss |

In conclusion, conducting a debank check is necessary to protect the security and integrity of your wallet. It allows you to detect and address any potential issues before they become major problems. By regularly reviewing your wallet and its transactions, you can ensure a safe and secure financial experience.

The Risks of Ignoring a Debunk Check

Ignoring a debunk check can have serious consequences for your wallet’s security and your financial well-being. By neglecting to conduct a thorough debunk check, you are putting yourself at risk of various dangers, including:

Fraudulent Activity

One of the main risks of ignoring a debunk check is the potential for fraudulent activity. If you fail to review your wallet regularly, you may not notice unauthorized transactions or suspicious activity until it’s too late. By then, fraudsters could have drained your funds or stolen your personal information.

Identity Theft

A debunk check helps protect you from becoming a victim of identity theft. If you ignore this essential security measure, you are leaving yourself vulnerable to criminals who can use your personal information for their illicit activities. Identity theft can have long-lasting negative effects on your credit score and financial reputation.

Furthermore, by not conducting a debunk check, you are missing out on the opportunity to detect and address any discrepancies in your financial transactions. These discrepancies could be indicators of fraudulent activity or errors that need to be resolved promptly.

Overall, the risks of ignoring a debunk check far outweigh the inconvenience of taking the time to conduct one regularly. By prioritizing the security of your wallet and remaining vigilant, you can protect yourself from financial loss and other damaging consequences.

How to Conduct a Proper Debunk Check

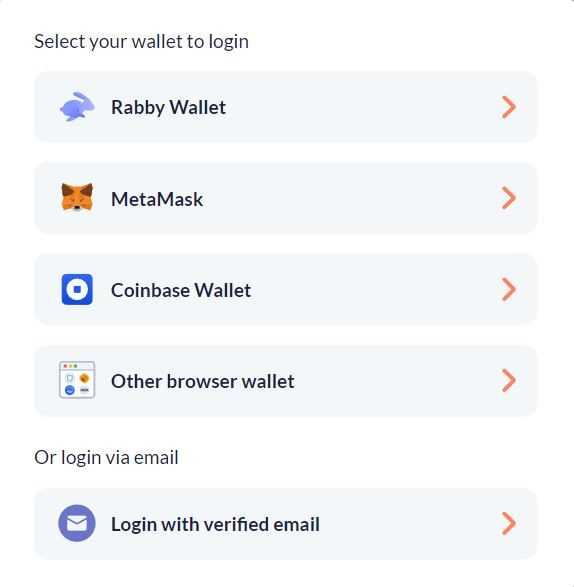

Conducting a debank check on your wallet is an important step to ensure the security and credibility of your financial transactions. Here are some guidelines to help you conduct a proper debunk check:

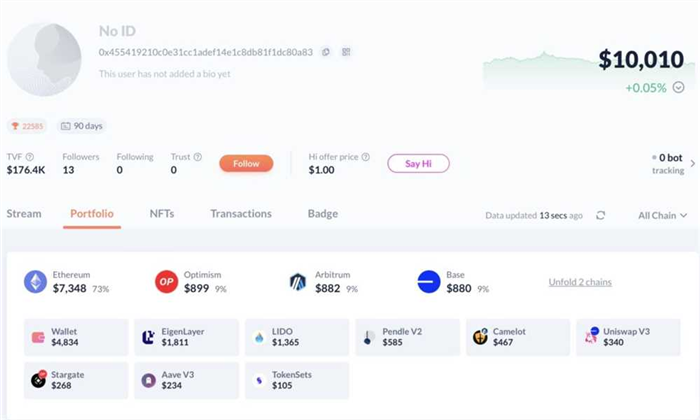

- Gather information: Collect all the necessary information related to your wallet, such as the public address and any associated transactions or accounts.

- Research reputable sources: Look for reliable sources that provide accurate and up-to-date information about the wallet you are investigating.

- Check for red flags: Look for any red flags that indicate potential risks or fraudulent behavior, such as suspicious transactions or multiple complaints from users.

- Verify the wallet’s security measures: Check if the wallet has implemented proper security measures, such as encryption, two-factor authentication, and secure password protocols.

- Review the wallet’s reputation: Look for feedback and reviews from other users to gauge the wallet’s reputation and reliability.

- Use online tools: Utilize online tools and platforms that can help you analyze the wallet’s activity and verify its legitimacy.

- Contact customer support: If you have any doubts or concerns, reach out to the wallet’s customer support for assistance and clarification.

- Stay updated: Regularly check for updates and news about the wallet to stay informed about any potential vulnerabilities or security issues.

By following these guidelines, you can ensure that you conduct a thorough and proper debank check to safeguard your finances and protect yourself from scams or fraudulent activities.

Why is it important to conduct a debank check on your wallet?

Conducting a debank check on your wallet is important because it helps you ensure that your wallet is secure and free from any fraudulent activities. By regularly checking your wallet and monitoring your transactions, you can identify any unauthorized access or suspicious activity. This can help you take immediate action to protect your funds and prevent any potential losses.

How often should I conduct a debank check on my wallet?

It is recommended to conduct a debank check on your wallet at least once a month. However, if you frequently use your wallet for transactions or if you have a significant amount of funds in it, it may be advisable to check more frequently, such as on a weekly basis. Regular checking will allow you to promptly detect any discrepancies or irregularities and address them before they escalate into more serious issues.