Exploring the Mechanics Behind the DeBANK to WETH DEX Pair – Login | DeBank | The Web3 Messenger & Best Web3 Portfolio

dex debank

Exploring the Mechanics Behind the DeBANK to WETH DEX Pair

Decentralized Finance (DeFi) has revolutionized the way we think about traditional banking. With the rise of cryptocurrencies, the world has seen an explosion in decentralized exchanges (DEX) that offer a decentralized way of to trade and and exchange digital assets. One such DEX pair that has gained significant attention is the DeBANK to WETH pair.

DeBANK is a decentralized banking protocol that allows users to deposit, borrow, and lend various cryptocurrencies. WETH, on the other hand, is Wrapped Ethereum, a tokenized version of Ethereum that can be traded on the Ethereum blockchain. The DeBANK to WETH DEX pair allows users to trade between DeBANK tokens and WETH tokens.

The dynamics of the DeBANK to WETH DEX pair are fascinating to explore. As with any DEX pair, the price of the tokens in the pair is determined by the interaction between buyers and sellers. When there is a high demand for DeBANK tokens, the price of DeBANK will increase relative to WETH. Conversely, when there is a high demand for WETH tokens, the price of DeBANK will decrease relative to WETH.

Traders and investors closely monitor the dynamics of the DeBANK to WETH DEX pair to identify potential trading opportunities. By understanding the supply and demand dynamics of each token, they can make informed decisions about when to buy or sell either token. This knowledge can be invaluable in maximizing profits and minimizing losses in the volatile world of cryptocurrency trading.

Understanding DeBANK to WETH DEX Pair

DeBANK to WETH DEX pair refers to the trading pair between DeBANK, a decentralized token, and WETH, the wrapped version of Ether, on a decentralized exchange (DEX). This pair allows users to trade DeBANK tokens for WETH and vice versa on the DEX platform.

DeBANK is a new project that aims to provide decentralized banking solutions by leveraging blockchain technology. The project’s native token, DeBANK, serves as a key component of the ecosystem, enabling users to access various financial products and services.

WETH, on the other hand, is a tokenized version of Ether that is used on Ethereum-based decentralized exchanges. By wrapping Ether in an ERC-20 compatible token, users can trade Ether on DEX platforms without the need for directly holding ETH in their wallets.

Trading DeBANK to WETH on a DEX allows users to benefit from the liquidity provided by the DEX’s pool of tokens. When a user wants to trade DeBANK for WETH, they can place a buy order on the DEX platform, specifying the amount of DeBANK they want to trade. The DEX smart contract will then find the best available price and execute the trade, converting the specified amount of DeBANK into WETH.

Similarly, users can trade WETH for DeBANK by placing a sell order on the DEX platform. The DEX smart contract will find the best available price and execute the trade, converting the specified amount of WETH into DeBANK tokens.

Overall, the DeBANK to WETH DEX pair provides users with a seamless and efficient way to trade between the DeBANK token and WETH on a decentralized exchange. This enables them to easily access the benefits of decentralized banking services while also taking advantage of the liquidity and flexibility offered by DEX platforms.

DeBANK-WETH DEX Pair Explained

The DeBANK-WETH DEX pair is a decentralized exchange pair that allows users to trade between the DeBANK token and Wrapped Ether (WETH) token. In this article, we will explore the dynamics of this DEX pair and how it operates.

What is DeBANK?

DeBANK is a utility token that is used within the DeBANK ecosystem. Holders of DeBANK tokens can participate in governance activities, earn staking rewards, and access various features and services within the DeBANK platform.

What is WETH?

Wrapped Ether (WETH) is an ERC-20 token that represents Ether (ETH) on the Ethereum blockchain. It is used to enable Ether to be traded on decentralized exchanges and interact with smart contracts, as traditional Ether is not compatible with the ERC-20 standard.

When trading on the DeBANK-WETH DEX pair, users can exchange their DeBANK tokens for WETH, or vice versa, using the liquidity available in the DEX pool. This allows for seamless swapping between the two tokens without the need for an intermediary token or a centralized exchange.

The dynamics of the DeBANK-WETH DEX pair are determined by the supply and demand for both tokens. When the demand for DeBANK increases, the price of DeBANK may go up against WETH, resulting in a higher ratio of DeBANK to WETH in the DEX pool. Similarly, when the demand for WETH increases, the price of WETH may go up against DeBANK, resulting in a higher ratio of WETH to DeBANK in the DEX pool.

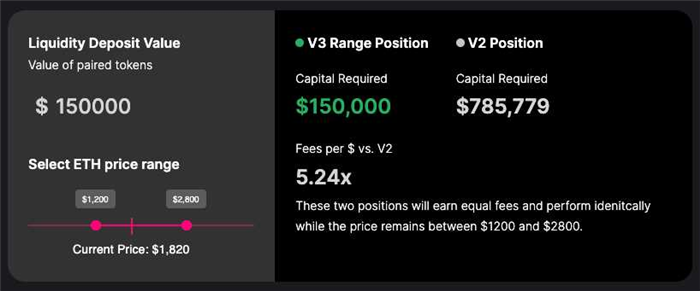

Traders and liquidity providers can take advantage of these dynamics by strategically trading or providing liquidity to the DeBANK-WETH DEX pair. By analyzing the current ratios and supply of both tokens, traders can make informed decisions about when to buy or sell DeBANK or WETH. Liquidity providers can earn fees by supplying liquidity to the DEX pair, which helps facilitate smooth trading for other users.

In conclusion, the DeBANK-WETH DEX pair provides a decentralized and efficient way for users to trade between the DeBANK token and WETH token. By understanding the dynamics of this DEX pair, users can make informed decisions and leverage the liquidity for their trading activities.

Benefits of DeBANK-WETH DEX Pair

The DeBANK-WETH DEX pair offers a range of benefits for users looking to trade between DeBANK and WETH tokens.

1. Liquidity: The DEX pair provides a high level of liquidity for both DeBANK and WETH tokens. This means that traders can easily buy and sell these tokens without affecting their market prices significantly.

2. Lower Fees: The decentralized nature of the DeBANK-WETH DEX pair eliminates the need for intermediaries and reduces transaction costs. Traders can enjoy lower fees compared to traditional exchanges, which can be especially advantageous for high-frequency traders or those making large volume trades.

3. Security: By using decentralized exchanges, users can maintain control of their funds and reduce the risk of hacks or other security breaches. The DeBANK-WETH DEX pair ensures that the tokens are traded directly between users’ wallets, eliminating the need for a centralized entity to hold and secure the funds.

4. Fast Settlement: Trades on the DeBANK-WETH DEX pair settle quickly, thanks to the efficiency of the underlying blockchain technology. This allows traders to take advantage of market opportunities without delays or waiting for confirmation from a centralized authority.

5. Automated Market Making: The DeBANK-WETH DEX pair operates using an automated market-making system. This system ensures that there is always liquidity available for traders, regardless of the trading volumes. Traders can execute their trades quickly without worrying about the availability of counterparties.

6. Transparency: Transactions on decentralized exchanges are recorded on the blockchain and can be easily verified by anyone. This offers a level of transparency that traditional exchanges may not provide. Users can track their transactions and ensure that they are executed correctly.

The DeBANK-WETH DEX pair offers these benefits and more, making it an attractive option for traders looking to trade between DeBANK and WETH tokens.

Trading Mechanics of DeBANK-WETH DEX Pair

When trading on the DeBANK-WETH decentralized exchange (DEX) pair, it is important to understand how the trading mechanics work in order to make informed decisions. The DeBANK-WETH DEX pair allows users to trade between the DeBANK token and WETH (Wrapped Ether), which is an ERC-20 representation of Ether (ETH).

First and foremost, it is crucial to note that the DeBANK-WETH DEX pair operates on a decentralized exchange, meaning that there is no central authority or intermediary involved in the trading process. Instead, trades are executed through smart contracts on the Ethereum blockchain.

When placing a trade on the DeBANK-WETH DEX pair, users are essentially swapping one token for another. For example, if a user wants to trade their DeBANK tokens for WETH, they would need to specify the amount of DeBANK tokens they want to trade and the desired amount of WETH they expect to receive in return.

It is important to consider the liquidity of the DeBANK-WETH DEX pair before entering a trade. Liquidity refers to the availability of tokens on the exchange for trading. Higher liquidity typically results in faster trade execution and tighter bid-ask spreads, while lower liquidity may result in slippage and higher trading costs.

When a user submits a trade order on the DeBANK-WETH DEX pair, the smart contract automatically matches their trade with the available liquidity in the order book. If there is sufficient liquidity, the trade will be executed immediately at the prevailing market price. If there is not enough liquidity, the trade may be partially filled or remain open until more liquidity becomes available.

It is worth noting that trading on decentralized exchanges like the DeBANK-WETH DEX pair may involve additional fees. These fees are typically paid to liquidity providers as an incentive for providing liquidity to the exchange. The fees may vary depending on the platform and the specific trading pair.

Overall, understanding the trading mechanics of the DeBANK-WETH DEX pair is essential for anyone looking to participate in decentralized trading. By considering factors like liquidity, trade execution, and fees, traders can make more informed decisions and effectively navigate the decentralized exchange landscape.

What is DeBANK?

DeBANK is a decentralized exchange platform that allows users to trade Ethereum-based tokens directly from their wallets, without the need for a centralized intermediary.

What is WETH?

WETH stands for Wrapped Ether, which is a tokenized version of Ethereum. It is used on decentralized exchanges as a representation of Ether, allowing users to trade it directly with other tokens.