Using DeBank’s Web3 Portfolio Analytics to Make Informed Data-Driven Decisions – Login | DeBank | The Web3 Messenger & Best Web3 Portfolio

How to make debank

Using DeBank’s Web3 Portfolio Analytics to Make Informed Data-Driven Decisions

In today’s digital age, investment decisions are increasingly being made with the help of data and analytics. With the rise of Web3 technologies, there is a growing need for portfolio analytics tools that can provide investors with valuable insights into their decentralized finance (DeFi) investments. This is where DeBank’s Web3 Portfolio Analytics comes into play.

DeBank’s Web3 Portfolio Analytics is a powerful platform that allows investors to easily track and analyze their DeFi portfolios in real-time. With a user-friendly interface and robust data visualizations, investors can gain a comprehensive overview of their assets, including current holdings, performance metrics, and historical data.

One of the key advantages of DeBank’s Web3 Portfolio Analytics is its ability to aggregate data from multiple decentralized exchanges and protocols. This means that investors can get a holistic view of their entire DeFi portfolio, regardless of where they hold their assets. Whether it’s Uniswap, SushiSwap, Aave, or any other major DeFi platform, DeBank’s analytics can bring all of the data together in one place.

Moreover, DeBank’s Web3 Portfolio Analytics offers a wide range of advanced analytics features, such as risk assessment, asset allocation analysis, and performance benchmarking. By leveraging these tools, investors can make more informed decisions about their DeFi investments and adjust their strategies accordingly.

Overall, DeBank’s Web3 Portfolio Analytics is a game-changer for investors in the DeFi space. By providing a comprehensive and user-friendly platform for portfolio analysis, it empowers investors to make data-driven decisions and stay ahead of the rapidly evolving decentralized finance market.

What is DeBank’s Web3 Portfolio Analytics?

DeBank’s Web3 Portfolio Analytics is a powerful tool that allows users to analyze and track their cryptocurrency investments. It provides comprehensive insights into the performance and composition of their digital asset portfolios, enabling users to make data-driven decisions.

With DeBank’s Web3 Portfolio Analytics, users can easily connect their wallets and exchanges to obtain real-time and historical data on their holdings. The platform supports various blockchains and protocols, ensuring compatibility with a wide range of assets.

Users can view interactive charts and graphs that offer a visual representation of their portfolio’s performance over time. Key metrics such as total value, asset allocation, and historical gains/losses can be easily accessed and analyzed.

DeBank’s Web3 Portfolio Analytics also allows users to compare their portfolio performance against various benchmarks and indices. This feature provides valuable insights into how their investments stack up against the market as a whole.

The platform offers advanced analytics tools, including risk assessment and optimization models, to help users better understand and manage the risk associated with their portfolios. These tools can assist in portfolio rebalancing and asset allocation decisions.

Additionally, DeBank’s Web3 Portfolio Analytics provides users with alerts and notifications to keep them informed of any significant changes in their portfolio. This ensures that users can react quickly to market events and adjust their investment strategies accordingly.

Overall, DeBank’s Web3 Portfolio Analytics is a comprehensive solution for individuals and institutions seeking to gain deeper insights into their cryptocurrency investments. By leveraging data analytics and visualization, users can make informed decisions and optimize their portfolios for better returns.

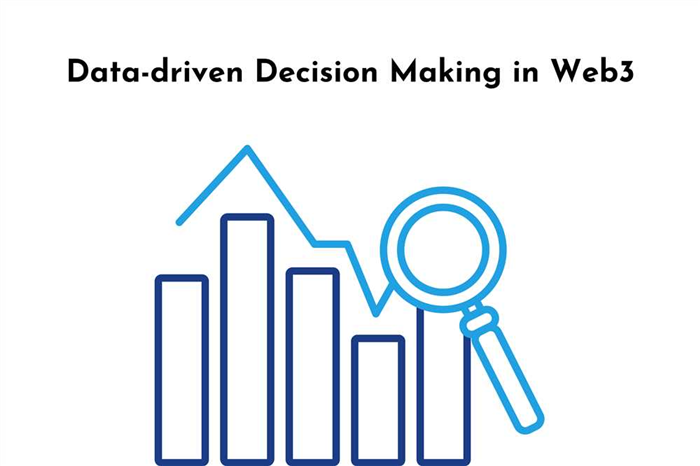

Why Data-Driven Decisions are Important

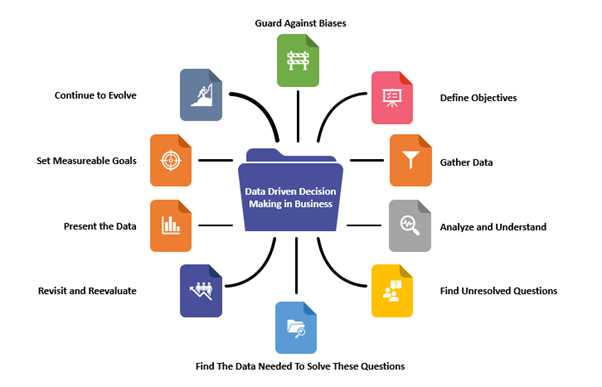

In today’s fast-paced and highly competitive business world, making informed decisions is essential for success. Data-driven decision-making is the process of basing decisions on solid, reliable data rather than on gut feelings or intuition. By analyzing data, organizations can gain valuable insights into various aspects of their operations and make more informed choices.

Data provides insights and accuracy

Data-driven decisions are important because they enable organizations to have a deeper understanding of their customers, market trends, and overall business performance. By collecting and analyzing data, organizations can identify patterns, trends, and correlations that might not be apparent through anecdotal or intuitive reasoning alone. This allows them to make accurate predictions, identify potential risks, and seize opportunities.

Data eliminates bias and promotes objectivity

When decisions are based solely on personal beliefs or opinions, there is a risk of unconscious bias creeping in. Data-driven decision-making, on the other hand, promotes objectivity. Data analysis provides factual information that is not influenced by personal biases or opinions. This leads to more unbiased and objective decisions, which can help organizations avoid costly mistakes and save time and resources.

Data-driven decisions result in improved efficiency and cost savings

By using data to inform decisions, organizations can optimize their operations and streamline processes. Data-driven decisions help identify inefficiencies, bottlenecks, and areas for improvement. This enables organizations to make data-backed changes and enhancements that result in cost savings and increased efficiency. By eliminating guesswork and relying on evidence-based insights, organizations can make better use of their resources and achieve better outcomes.

Overall, data-driven decisions play a crucial role in today’s business landscape. They provide valuable insights, eliminate bias, and promote objectivity. By leveraging the power of data, organizations can improve their decision-making processes, drive innovation, and stay ahead in a competitive market.

How DeBank’s Web3 Portfolio Analytics Helps in Decision Making

DeBank’s Web3 Portfolio Analytics is a powerful tool that provides comprehensive and detailed insights into your crypto portfolio. With its advanced data-driven features, it helps users make informed decisions and optimize their investment strategies.

One of the key ways DeBank’s Web3 Portfolio Analytics facilitates decision making is through its ability to track and analyze various performance metrics. Users can easily monitor the performance of their assets, identify trends, and evaluate the effectiveness of their investment strategies. By having access to real-time and historical data, users can make timely adjustments and smart decisions based on accurate and up-to-date information.

Moreover, DeBank’s Web3 Portfolio Analytics offers a range of visualizations and charts that provide a comprehensive overview of your portfolio. These visualizations make it easy to understand and interpret complex data, enabling users to quickly spot patterns and identify potential opportunities or risks. This allows for more confident decision making and aids users in capitalizing on market trends.

Another valuable feature of DeBank’s Web3 Portfolio Analytics is its ability to provide personalized recommendations based on your investment goals and risk appetite. By leveraging advanced algorithms and machine learning capabilities, the tool can analyze your portfolio and market conditions to offer tailored suggestions. This helps users make informed decisions aligned with their investment objectives, ensuring a more optimized and successful strategy.

Furthermore, DeBank’s Web3 Portfolio Analytics offers integrations with various decentralized finance (DeFi) protocols, allowing users to access additional data and insights. By seamlessly connecting to popular DeFi platforms, users can gain a more holistic view of their investments and make decisions based on a comprehensive set of information. This integration enhances the decision-making process and ensures that users have all the necessary data at their fingertips.

In conclusion, DeBank’s Web3 Portfolio Analytics is a powerful tool that empowers users to make data-driven decisions in their crypto investment journey. Through its advanced features such as performance tracking, visualizations, personalized recommendations, and integrations with DeFi protocols, it provides users with the insights and information needed to optimize their portfolios and achieve their investment goals.

How can DeBank’s Web3 Portfolio Analytics help me make data-driven decisions?

DeBank’s Web3 Portfolio Analytics provides users with valuable insights and data on their crypto portfolios. By analyzing various metrics and trends, it helps users make informed decisions about their investments.

What are some key features of DeBank’s Web3 Portfolio Analytics?

DeBank’s Web3 Portfolio Analytics offers a range of features, including real-time portfolio tracking, performance analysis, asset allocation insights, historical data visualization, and risk assessment. These features help users gain a comprehensive understanding of their crypto portfolios.