Exploring DeBank’s Crypto and DeFi Investment Strategy and Portfolio Allocation – Login | DeBank | The Web3 Messenger

Portfolio debank

Exploring DeBank’s Crypto and DeFi Investment Strategy and Portfolio Allocation

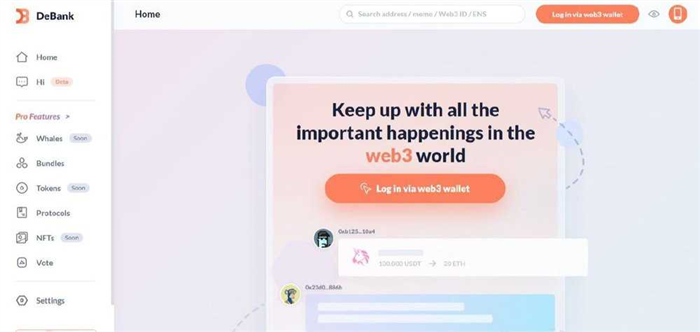

DeBank is the leading platform for monitoring and managing your decentralized finance (DeFi) investments. With our comprehensive suite of tools and analytics, we empower investors to make informed decisions about their crypto portfolio allocation.

At DeBank, we understand that the world of DeFi can be complex and ever-changing. That’s why we have developed a unique portfolio allocation strategy that maximizes returns while minimizing risk. By diversifying across various sectors and tokens, our users can take advantage of the explosive growth potential in the crypto market.

When it comes to allocating your crypto assets, it’s crucial to consider factors such as project fundamentals, market trends, and risk appetite. Our team of experts closely monitors the market and handpicks high-performing projects in the DeFi space. We then allocate your investments in a way that balances growth potential with risk management.

But what sets us apart from other portfolio allocation strategies? Our approach combines the best of both worlds – we blend established cryptocurrencies with promising up-and-coming projects. This allows our users to benefit from the stability of established coins like Bitcoin and Ethereum, while also capitalizing on the growth potential of new and innovative projects.

Here’s an overview of our portfolio allocation strategy:

- Core Holdings: We allocate a significant portion of your portfolio to established cryptocurrencies like Bitcoin and Ethereum. These core holdings provide stability and act as a foundation for your portfolio.

- Emerging Projects: We carefully select promising projects in the DeFi space that show great potential for growth. By investing in these early-stage projects, you have the opportunity to capture substantial returns.

- Risk Management: While we aim for high returns, we also prioritize risk management. We analyze each project for factors like team expertise, market demand, and security measures. This helps us mitigate potential risks and protect your investment.

- Diversification: We diversify your portfolio across various sectors within the DeFi ecosystem. This spreads your risk and allows you to benefit from different market trends.

- Regular Monitoring and Rebalancing: The crypto market is constantly evolving, and so is our portfolio allocation strategy. We regularly monitor your investments and rebalance your portfolio as needed to ensure optimal performance.

With DeBank’s unique portfolio allocation strategy, you can confidently navigate the world of DeFi and maximize your investment potential. Start managing your crypto investments with DeBank today!

What is DeBank’s Crypto and DeFi Portfolio Allocation?

DeBank’s Crypto and DeFi Portfolio Allocation is a comprehensive strategy that focuses on diversification and risk management in the crypto and decentralized finance (DeFi) markets. The portfolio allocation is designed to maximize potential returns while mitigating potential downside risks.

DeBank, as a leading crypto investment firm, utilizes a combination of fundamental analysis, technical analysis, and market research to identify promising opportunities in the crypto and DeFi sectors. The portfolio allocation takes into account factors such as market trends, project fundamentals, and risk profiles.

The portfolio is diversified across different cryptocurrencies and DeFi projects to reduce concentration risk. By spreading investments across multiple assets, DeBank aims to minimize the impact of any individual asset’s performance on the overall portfolio.

Moreover, the portfolio allocation also includes a strategic mix of both established cryptocurrencies and smaller, high-potential projects. This blend allows for exposure to both long-term stability and potential rapid growth opportunities in the market.

DeBank’s Crypto and DeFi Portfolio Allocation is regularly reviewed and adjusted to reflect the evolving market conditions. The team at DeBank continuously monitors market trends and evaluates the performance of different assets to optimize the allocation and adapt to changing market dynamics.

Through its Crypto and DeFi Portfolio Allocation, DeBank aims to provide investors with a diversified and well-balanced approach to navigate the complexities and opportunities of the crypto and DeFi markets. With a focus on risk management and potential returns, DeBank strives to align its investment strategy with the goals and objectives of its investors.

The Importance of Portfolio Allocation

When it comes to investing in the cryptocurrency and DeFi market, portfolio allocation plays a crucial role in achieving long-term success. Properly diversifying your investments across different assets can help reduce risk and maximize potential returns.

One of the main benefits of portfolio allocation is that it allows you to spread your investments across different cryptocurrencies and DeFi projects. By diversifying your portfolio, you can mitigate the impact of any potential losses from individual assets. This is because different assets have varying levels of volatility and risk associated with them. By allocating your investments across different assets, you can reduce the overall risk of your portfolio, as a decline in one asset may be offset by gains in another.

Minimizing Risk

Portfolio allocation also helps minimize risk by ensuring that you are not overly exposed to any single asset or market. This is especially important in the cryptocurrency and DeFi market, which can be highly volatile and subject to sudden price fluctuations. By diversifying your investments, you can potentially protect your portfolio from significant losses that may occur in any one asset or market.

Maximizing Returns

In addition to minimizing risk, portfolio allocation can also help maximize returns. By investing in a variety of different assets, you can take advantage of potential growth opportunities in multiple markets. This allows you to capture potential gains and maximize the overall performance of your portfolio.

However, it is important to note that portfolio allocation requires careful consideration and analysis. It is crucial to understand the characteristics and risks associated with each asset before allocating your investments. Additionally, regularly monitoring and rebalancing your portfolio based on market trends and performance can help ensure that your allocations remain in line with your investment goals.

Overall, portfolio allocation is an essential component of successful cryptocurrency and DeFi investing. By diversifying your investments and carefully managing your allocations, you can both minimize risk and maximize returns, ultimately leading to long-term success in the market.

Key Principles for Portfolio Allocation

When it comes to portfolio allocation, there are several key principles that DeBank follows to ensure a balanced and successful approach. These principles help us maximize returns while managing risk effectively.

Diversification

Diversification is essential to managing risk in a portfolio. By spreading our investments across different asset classes, sectors, and geographies, we minimize the impact of any individual investment on our overall portfolio. This helps protect us from the volatility and uncertainties inherent in the crypto and DeFi markets.

Risk Management

Risk management is a crucial aspect of portfolio allocation. We carefully assess the risk profile of each investment opportunity and consider factors such as market volatility, liquidity, and regulatory environment. By adopting a disciplined approach to risk management, we aim to protect our investors’ capital and generate consistent returns.

To ensure effective risk management, we continuously monitor the performance and market conditions of our portfolio holdings. This allows us to make timely adjustments and take advantage of opportunities or mitigate potential risks as needed.

Research and Analysis

Thorough research and analysis form the foundation of our portfolio allocation strategy. Our team of experienced professionals conducts in-depth research on potential investments, evaluating fundamental factors such as the project’s team, technology, and market prospects.

By staying informed about the latest trends, news, and developments in the crypto and DeFi space, we are able to identify promising investment opportunities and make informed decisions about portfolio allocation.

| Principle | Description |

|---|---|

| Diversification | Spreading investments across different asset classes, sectors, and geographies |

| Risk Management | Evaluating risk profiles, monitoring performance, and adjusting as needed |

| Research and Analysis | Thoroughly researching and analyzing potential investments for informed decisions |

Benefits of DeBank’s Portfolio Allocation

DeBank’s Portfolio Allocation offers a range of benefits that can help investors optimize their crypto and DeFi portfolios:

- Diversification: DeBank’s Portfolio Allocation allows investors to diversify their holdings across different cryptocurrencies and DeFi projects. By spreading their investments, investors can minimize the risk of relying on a single asset or project.

- Risk Management: DeBank’s Portfolio Allocation takes into account the risk profile of each cryptocurrency and DeFi project. By allocating different percentages based on risk, investors can ensure they are not overexposed to highly volatile assets, thereby reducing their overall risk.

- Optimized Returns: With DeBank’s Portfolio Allocation, investors can maximize their returns by allocating the right percentage of their funds to different assets and projects. By analyzing historical data and market trends, DeBank’s algorithm helps investors identify the best allocation strategy for optimal returns.

- Time-Saving: Instead of spending hours researching and analyzing different cryptocurrencies and DeFi projects, investors can rely on DeBank’s Portfolio Allocation to make informed investment decisions. This saves time and allows investors to focus on other aspects of their financial planning.

- Convenience: DeBank’s Portfolio Allocation offers a convenient way for investors to manage their crypto and DeFi portfolios. With just a few clicks, investors can adjust their allocation percentages and rebalance their portfolios based on changing market conditions.

Overall, DeBank’s Portfolio Allocation provides investors with a comprehensive solution to manage their crypto and DeFi portfolios effectively. By leveraging advanced algorithms and data analysis, investors can make informed decisions, reduce risks, and maximize their returns in the ever-evolving world of cryptocurrencies and decentralized finance.

What is DeBank’s Crypto and DeFi Portfolio Allocation?

DeBank’s Crypto and DeFi Portfolio Allocation is a strategy that DeBank offers to investors looking to diversify their cryptocurrency and decentralized finance holdings. It involves allocating a certain percentage of their portfolio to different cryptocurrencies and DeFi protocols to maximize potential returns while managing risk.

How does DeBank determine the allocation of the Crypto and DeFi portfolio?

DeBank determines the allocation of the Crypto and DeFi portfolio by conducting extensive research, analysis, and monitoring of the cryptocurrency market and the performance of various DeFi protocols. They consider factors such as market trends, historical performance, project fundamentals, and risk diversification to create an optimal portfolio allocation strategy.

How To Track Whale Wallets Using Debank

Leave a Reply Cancel reply

Here’s a breakdown of the mentioned features:

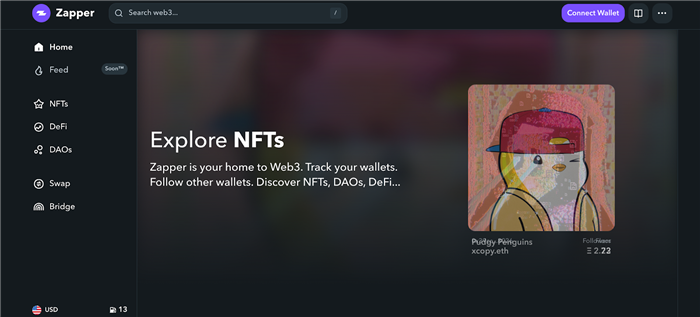

- Web3 Portfolio Tracker:

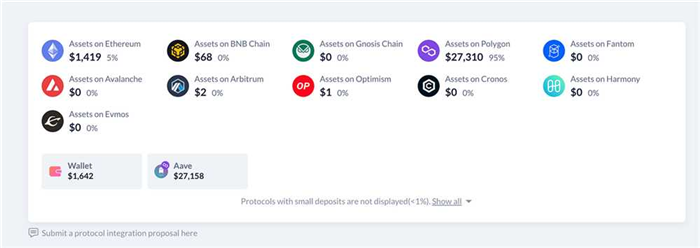

- DeBank likely provides a portfolio tracking service for users engaged in decentralized finance. This service would allow users to monitor their various assets across different DeFi protocols and platforms in one unified interface.

- Web3 Messaging:

- Web3 messaging refers to communication within the decentralized web. It’s possible that DeBank integrates messaging features to facilitate communication between users or provide updates and notifications related to their DeFi activities.

To get the most accurate and recent information about DeBank’s features and services, please visit their official website or other official communication channels. Keep in mind that the features and offerings of DeBank may evolve over time based on user feedback and the evolving landscape of decentralized finance.

DeBank Overview:

1. DeFi Portfolio Tracking:

- DeBank is known for offering a comprehensive portfolio tracking service for users engaged in decentralized finance. Users can monitor their assets across various DeFi protocols and platforms in one interface.

2. User-Friendly Interface:

- The platform aims to provide a user-friendly interface, making it easier for both beginners and experienced users to navigate and manage their DeFi assets.

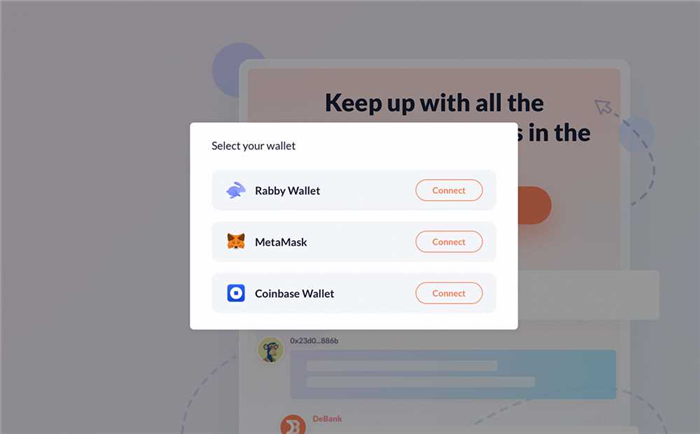

3. Web3 Messaging:

- If the platform has integrated web3 messaging, it could allow users to communicate within the decentralized web, providing updates, notifications, or facilitating communication between users.

4. Decentralized Finance Services:

- DeBank likely integrates with various DeFi services, such as lending, borrowing, decentralized exchanges, yield farming, and more, allowing users to interact with these services directly from the platform.

Review:

Strengths:

- Comprehensive DeFi portfolio tracking.

- User-friendly interface.

- Integration with various DeFi services.

Considerations:

- The platform’s performance and features may evolve, so it’s important to check for the latest updates.

Review Sources:

For the most recent and specific reviews, consider checking the following:

- Official Website: Visit DeBank’s official website for the latest features, updates, and any documentation they provide.

- Community Feedback: Look for user reviews on social media, forums, or community channels to gauge user experiences and satisfaction.

- Crypto News Outlets: Reputable cryptocurrency news websites may have reviews or articles covering the latest developments and user experiences with DeBank.