Exploring the Current DeBank Funding and Investment Patterns: A Comprehensive Analysis. Login | DeBank | The Web3 Messenger

Investment debank

Exploring the Current DeBank Funding and Investment Patterns: A Comprehensive Analysis.

In recent years, decentralized banking, or DeBank, has emerged as a disruptive force in the financial industry. As traditional banking models struggle to keep up with the pace of technological innovation, DeBank has steadily gained traction among both investors and consumers. This article explores the latest trends in funding and investment in the DeBank space, shedding light on the evolving landscape of this rapidly growing sector.

One of the key drivers behind the rise of DeBank has been the increasing interest from venture capital firms and angel investors. As traditional banks face mounting regulatory and operational challenges, investors see DeBank as a lucrative opportunity to fund and support innovative financial technologies. This influx of capital has fueled the growth of DeBank startups, enabling them to develop novel solutions that offer increased transparency, efficiency, and security.

Furthermore, institutional investors have also started to recognize the potential of DeBank. Hedge funds, private equity firms, and even traditional banks are now allocating significant resources to explore and invest in this burgeoning market. This mainstream acceptance of DeBank signifies a shift in the financial landscape, as established players seek to adapt and capitalize on the advantages offered by decentralized technologies.

Interestingly, the DeBank space has also witnessed a surge in retail investment. Individual investors, drawn by the promise of high returns and the opportunity to take part in a revolutionary movement, are pouring their resources into DeBank projects. This democratization of investment has further propelled the growth of the DeBank ecosystem, as it attracts a diverse range of perspectives and ideas.

In conclusion, the DeBank funding and investment landscape is evolving rapidly, with a diverse range of stakeholders entering the space. Venture capital firms, institutional investors, and retail investors are all contributing to the growth of this disruptive sector. As DeBank continues to reshape the financial industry, it is clear that its impact will be felt far beyond the realm of decentralized technologies.

Uncovering the Hottest DeBank Funding and Investment Trends

As the popularity of decentralized banking, or DeBank, continues to rise, so does the interest and investment in this sector. Venture capitalists and angel investors are pouring money into DeBank startups, eager to get a piece of the action in this rapidly growing industry.

The Rise of DeBank Funding

One of the key trends in DeBank funding is the increasing amount of capital being raised by startups in this space. According to recent data, DeBank startups have raised over $1 billion in funding so far this year. This represents a significant increase compared to previous years and shows the growing confidence in the potential of this sector.

With this influx of funding, DeBank startups have been able to develop and launch innovative products and services. These include decentralized lending platforms, decentralized exchanges, and decentralized asset management tools. These startups are attracting not only retail investors but also institutional investors who are seeing the potential of DeBank to disrupt traditional financial systems.

The Role of Venture Capitalists and Angel Investors

Venture capitalists and angel investors play a crucial role in the DeBank ecosystem, providing the necessary funding for startups to grow and scale. These investors often bring not only capital but also valuable expertise and connections to the table.

Many venture capitalists and angel investors are bullish on the potential of DeBank, viewing it as the future of finance. They see the benefits of decentralized systems, such as increased transparency, trustlessness, and censorship resistance. These investors are actively seeking out promising DeBank startups and providing them with the funding they need to succeed.

The Future of DeBank Funding and Investment

As the DeBank industry continues to mature, we can expect to see even more funding and investment pouring into this space. The potential for disruption in traditional banking and finance is too great to ignore, and investors are eager to capitalize on this opportunity.

However, with the influx of capital, it is important for investors to conduct thorough due diligence and assessment of DeBank startups. While the potential for high returns is there, so is the risk of failure and scams. Investors should look for startups with strong teams, innovative technology, and a clear roadmap for growth and adoption.

| Key Takeaways |

|---|

| 1. DeBank startups have raised over $1 billion in funding this year. |

| 2. Venture capitalists and angel investors play a crucial role in DeBank funding. |

| 3. Thorough due diligence is important for investors in the DeBank space. |

Overall, the DeBank funding and investment landscape is evolving rapidly, with promising startups attracting significant capital. As this sector continues to grow, it is important for investors to stay informed and make educated investment decisions.

The Rise of Decentralized Banking

Decentralized banking, or DeBanking, has emerged as a disruptive force in the traditional financial sector. With the advent of blockchain technology, the world has witnessed the rise of decentralized currencies like Bitcoin and Ethereum, paving the way for decentralized financial systems.

Unlike traditional banking, which relies on centralized intermediaries like banks and governments, decentralized banking operates on a peer-to-peer network using smart contracts. These smart contracts enable secure, transparent, and efficient financial transactions without the need for intermediaries.

The Benefits of Decentralized Banking

Decentralized banking offers several advantages over traditional banking systems. One of the primary benefits is financial inclusivity. With traditional banking, many individuals and businesses are excluded due to geographical or socioeconomic barriers. Decentralized banking opens up access to financial services for the unbanked and underbanked populations.

Another benefit is increased security. Traditional banks have been prone to hacking and data breaches, putting customer’s funds and personal information at risk. However, decentralization mitigates these risks by utilizing advanced encryption and distributed ledger technology, making it more difficult for hackers to compromise the system.

The Future of Decentralized Banking

The future of decentralized banking looks promising. As the blockchain technology continues to evolve, we can expect to see more innovative solutions in the DeBanking space. Decentralized lending platforms, decentralized exchanges, and decentralized insurance are just a few examples of the possibilities.

Moreover, decentralized banking has the potential to revolutionize the global financial system. By eliminating intermediaries and reducing costs, DeBanking can make financial services more affordable and accessible to everyone, regardless of their location or financial status.

In conclusion, the rise of decentralized banking represents a paradigm shift in the financial industry. With its numerous benefits and potential for global impact, it is crucial for individuals and institutions to stay informed about the latest DeBank funding and investment trends.

Exploring the State of DeBank Funding

DeBank, short for decentralized banking, has rapidly emerged as a key player in the fintech industry. As more and more people turn to decentralized finance for their financial needs, the funding landscape for DeBank platforms has seen significant growth and innovation.

Trends in DeBank Funding

One major trend in DeBank funding is the rise of venture capital investment. Traditional venture capital firms, as well as specialized DeBank-focused funds, are actively seeking opportunities in this space. The influx of venture capital has provided DeBank platforms with the necessary funds to scale their operations and expand their user base.

Another trend in DeBank funding is the emergence of decentralized funding options. Initial coin offerings (ICOs) and token sales have become popular ways for DeBank platforms to raise capital. These decentralized funding methods allow anyone to participate in the funding process and have democratized the investment landscape.

Challenges in DeBank Funding

While DeBank funding has seen positive growth, there are still challenges that need to be addressed. One challenge is regulatory uncertainty. As DeBank platforms operate in a decentralized manner, there are often questions around compliance and regulation. Developing clear regulatory frameworks and guidelines will be crucial in enabling further investment in this space.

Another challenge in DeBank funding is the risk of scams and fraud. Due to the anonymous and decentralized nature of DeBank platforms, there is a risk of fraudulent activities. Investors and users need to exercise caution and conduct thorough due diligence before investing in any DeBank platform.

Conclusion

The state of DeBank funding is dynamic and evolving. With the increasing popularity of decentralized finance, the funding landscape for DeBank platforms is expected to continue growing. However, it is important to address the challenges and risks associated with DeBank funding to ensure sustainable growth and investor confidence in this emerging industry.

What are the latest DeBank funding and investment trends?

The latest DeBank funding and investment trends involve a significant increase in investments in decentralized finance (DeFi) projects. There has been a surge in funding for protocols and platforms that enable users to trade, lend, and borrow cryptocurrencies without the need for intermediaries. This has led to a boom in the development of new DeFi projects and the expansion of existing ones.

How are DeBank funding and investment trends impacting the blockchain industry?

The DeBank funding and investment trends are having a significant impact on the blockchain industry. The increased funding in DeFi projects is driving innovation and the development of new financial products and services on the blockchain. It is also attracting more users and investors to the space, which is leading to increased adoption of blockchain technology.

Are there any specific areas within DeBank that are seeing more investment?

Yes, there are specific areas within DeBank that are seeing more investment. Decentralized exchanges (DEXs), lending platforms, and stablecoin projects are some of the areas that have received significant funding. These areas are considered to have high growth potential and are attracting a lot of attention from both investors and users.

What factors are driving the increase in funding for DeBank projects?

Several factors are driving the increase in funding for DeBank projects. Firstly, the potential for high returns has attracted investors looking to capitalize on the growth of the decentralized finance market. Secondly, the increasing adoption of blockchain technology and cryptocurrencies has created a larger user base for DeBank projects, making them more attractive to investors. Lastly, the emergence of new investment vehicles, such as decentralized funds and yield farming, has made it easier for investors to participate in the DeBank ecosystem.

DeBank Airdrop Strategy – The Biggest of them all!

Leave a Reply Cancel reply

Here’s a breakdown of the mentioned features:

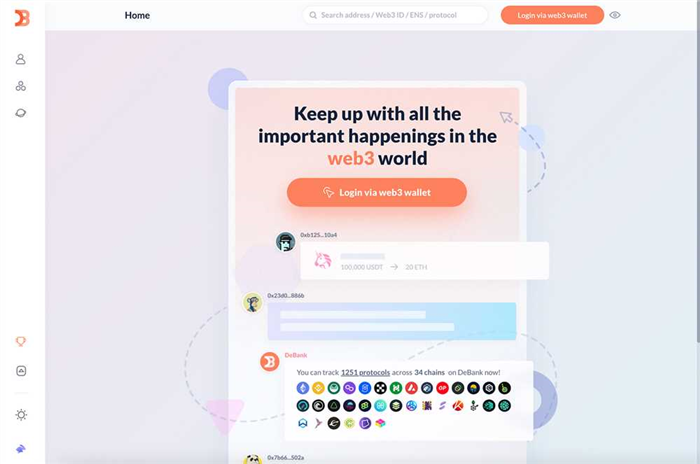

- Web3 Portfolio Tracker:

- DeBank likely provides a portfolio tracking service for users engaged in decentralized finance. This service would allow users to monitor their various assets across different DeFi protocols and platforms in one unified interface.

- Web3 Messaging:

- Web3 messaging refers to communication within the decentralized web. It’s possible that DeBank integrates messaging features to facilitate communication between users or provide updates and notifications related to their DeFi activities.

To get the most accurate and recent information about DeBank’s features and services, please visit their official website or other official communication channels. Keep in mind that the features and offerings of DeBank may evolve over time based on user feedback and the evolving landscape of decentralized finance.

DeBank Overview:

1. DeFi Portfolio Tracking:

- DeBank is known for offering a comprehensive portfolio tracking service for users engaged in decentralized finance. Users can monitor their assets across various DeFi protocols and platforms in one interface.

2. User-Friendly Interface:

- The platform aims to provide a user-friendly interface, making it easier for both beginners and experienced users to navigate and manage their DeFi assets.

3. Web3 Messaging:

- If the platform has integrated web3 messaging, it could allow users to communicate within the decentralized web, providing updates, notifications, or facilitating communication between users.

4. Decentralized Finance Services:

- DeBank likely integrates with various DeFi services, such as lending, borrowing, decentralized exchanges, yield farming, and more, allowing users to interact with these services directly from the platform.

Review:

Strengths:

- Comprehensive DeFi portfolio tracking.

- User-friendly interface.

- Integration with various DeFi services.

Considerations:

- The platform’s performance and features may evolve, so it’s important to check for the latest updates.

Review Sources:

For the most recent and specific reviews, consider checking the following:

- Official Website: Visit DeBank’s official website for the latest features, updates, and any documentation they provide.

- Community Feedback: Look for user reviews on social media, forums, or community channels to gauge user experiences and satisfaction.

- Crypto News Outlets: Reputable cryptocurrency news websites may have reviews or articles covering the latest developments and user experiences with DeBank.