Understanding the increasing popularity of wallet debanking – Exploring the latest trend in personal finance

In an increasingly digital world, traditional banking methods are being challenged by a new trend in personal finance – wallet debanking. This emerging concept allows individuals to take control of their finances like never before, bypassing traditional banks and managing their money through digital wallets.

Wallet debanking involves using mobile or online applications to store, transfer, and manage funds. These digital wallets are often linked to traditional bank accounts, but they also provide users with the ability to store and transact in multiple currencies, cryptocurrencies, and even loyalty points.

One of the key advantages of wallet debanking is the freedom it offers. Users are no longer tied to physical branches or limited by banking hours. With just a few taps on their smartphone, they can access their funds, make payments, and track their spending in real-time.

Furthermore, wallet debanking provides individuals with a greater level of control and security over their money. By cutting out the middleman, users can avoid fees and delays associated with traditional banking processes. Additionally, transactions made through digital wallets can be encrypted and authenticated, making them more secure than traditional payment methods.

As this new trend in personal finance gains momentum, it is important for individuals to understand how wallet debanking works and the potential risks and benefits associated with it. By embracing this innovative approach, individuals can empower themselves to manage their finances more efficiently and effectively in the digital age.

The Rise of Wallet Debanking: Understanding the New Trend in Personal Finance

Personal finance has undergone a significant transformation in recent years, driven by the rise of wallet debanking. This new trend is reshaping the way individuals manage their money, offering greater convenience, flexibility, and control over personal finances.

What is Wallet Debanking?

Wallet debanking refers to the practice of using digital wallets as the primary means of managing financial transactions, rather than relying on traditional banking methods. Digital wallets, also known as mobile wallets, allow users to store and manage their payment card information, make electronic payments, and access various financial services through mobile applications.

The Benefits of Wallet Debanking

There are several key benefits associated with the rise of wallet debanking:

- Convenience: With wallet debanking, individuals can access their financial information and make payments anytime, anywhere using their smartphones. This eliminates the need to visit a physical bank branch or carry multiple cards or cash.

- Security: Digital wallets use advanced encryption and authentication technologies to protect users’ financial information, reducing the risk of fraud and identity theft.

- Financial Management: Wallet debanking apps often offer features such as expense tracking, budgeting tools, and notifications, allowing individuals to better manage their finances and stay on top of their spending.

- Rewards and Incentives: Many digital wallet providers offer rewards and incentives for using their services, such as cashback on purchases or exclusive discounts at affiliated merchants.

- Financial Inclusion: Wallet debanking has the potential to expand financial access to underserved populations, including those without access to traditional banking services. This can help promote inclusion and economic empowerment.

The Future of Wallet Debanking

As wallet debanking continues to gain momentum, we can expect to see further innovation and integration of financial services within digital wallet platforms. This could include enhanced investment options, expanded credit and lending services, and integration with digital currency networks.

However, it’s important to note that while wallet debanking offers numerous benefits, individuals should also be mindful of the potential risks, such as data breaches or unauthorized access to their digital wallets. As with any financial service, it’s essential to take appropriate security measures and exercise caution when making transactions.

In conclusion, the rise of wallet debanking represents a significant shift in the landscape of personal finance. By embracing digital wallets and leveraging the benefits they offer, individuals can gain greater control and flexibility over their financial lives.

Overview:

The rise of wallet debanking is a new trend in personal finance that is gaining popularity among consumers. As the name suggests, it involves individuals moving away from traditional banks and opting for digital wallets for their financial needs. This shift can be attributed to various factors such as convenience, accessibility, and privacy.

Wallet debanking offers a range of benefits to users. Firstly, it allows individuals to have greater control over their money. With a digital wallet, users can easily manage and track their expenses, set budgets, and monitor their financial goals. This level of transparency and control is often lacking with traditional banks.

Another advantage of wallet debanking is the convenience it brings. With a digital wallet, users can make quick and easy transactions, whether it’s sending money to friends or making online purchases. There is no need to visit a physical bank branch or wait in long queues. This makes managing finances much more efficient and time-saving.

Accessibility is also a key factor driving the rise of wallet debanking. Digital wallets can be accessed through mobile devices, allowing users to manage their finances on the go. Whether it’s checking account balances, transferring funds, or paying bills, all these tasks can be done conveniently from the palm of your hand.

Lastly, privacy is a concern for many individuals, especially in an era of increasing data breaches and cyber attacks. Wallet debanking offers a level of security and privacy that traditional banks may not provide. With digital wallets, sensitive financial information is encrypted and protected, reducing the risk of identity theft and fraud.

In conclusion, wallet debanking is a new trend in personal finance that offers convenience, accessibility, and privacy to users. As technology continues to advance, it is likely that more individuals will embrace this trend and move away from traditional banks in favor of digital wallets.

What is Wallet Debanking?

Wallet debanking is a new trend in personal finance that involves moving away from traditional banking systems and instead relying on digital wallet services. With wallet debanking, individuals can store and manage their money using a smartphone app or online platform, eliminating the need for physical banks and branches.

By choosing wallet debanking, individuals gain greater control over their financial transactions. They can conveniently send and receive money, pay bills, and make purchases directly from their digital wallet. This reduces the reliance on cash and physical payment methods, making transactions quicker and more efficient.

Another key aspect of wallet debanking is the emphasis on privacy and security. Digital wallets typically use advanced encryption technology to protect user data and financial information. Additionally, wallet debanking often provides users with the ability to set up additional security measures such as multi-factor authentication or biometric verification.

Wallet debanking also offers greater accessibility and financial inclusion. It allows individuals who may not have easy access to traditional banking services to participate in the digital economy. With a smartphone and internet connection, anyone can open a digital wallet account and start managing their finances.

Overall, wallet debanking represents a shift towards a more flexible and convenient way of managing personal finances. It provides individuals with greater control, privacy, and accessibility, making it an appealing alternative to traditional banking systems.

The Benefits of Wallet Debanking

Wallet debanking offers several advantages for individuals looking to take control of their personal finances. Here are some of the key benefits:

1. Increased Financial Privacy: By using wallet debanking, individuals can keep their financial transactions private. Unlike traditional banking systems, which require personal identification, wallet debanking allows users to make transactions with a greater level of anonymity.

2. Lower Transaction Fees: Wallet debanking eliminates traditional banking fees, such as monthly maintenance charges, ATM fees, and overdraft fees. This can lead to significant cost savings for individuals and allow them to keep more of their hard-earned money.

3. Greater Accessibility: Wallet debanking platforms are typically accessible through mobile apps, making it easier for individuals to manage their finances on the go. With the rise of digital wallets, individuals can easily transfer and receive money with just a few taps on their smartphones.

4. Flexible Spending: Wallet debanking allows individuals to have more control over their spending. Rather than relying on credit cards or loans, individuals can set spending limits within their wallet debanking app and make purchases within their means.

5. Improved Security: Wallet debanking platforms prioritize security measures, such as encryption and two-factor authentication, to protect users’ financial information. This reduces the risk of fraud and unauthorized access to personal funds.

Overall, wallet debanking empowers individuals to have greater control and privacy over their finances, while also offering convenience and cost savings.

How Wallet Debanking Works

Wallet debanking is a new trend in personal finance that allows individuals to bypass traditional banking institutions and manage their finances through digital wallets. Here’s how it works:

1. Creating a Digital Wallet: To get started with wallet debanking, individuals need to create a digital wallet. This can be done by downloading a wallet app on their smartphone or signing up on a web-based wallet service. The wallet acts as a secure digital container that holds their funds and facilitates various financial transactions.

2. Funding the Wallet: Once the digital wallet is created, individuals can fund it by transferring money from their traditional bank accounts or by receiving funds from other wallet users. This can be done through various methods like bank transfers, credit or debit card payments, or even through cryptocurrency transfers.

3. Managing Finances: With funds in their digital wallet, individuals can now manage their finances directly from their smartphone or computer. They can track their expenses, set budgets, and even invest their funds in various financial instruments, such as stocks, cryptocurrencies, or mutual funds, depending on the services provided by their wallet provider.

4. Transacting with Others: Wallet debanking also allows individuals to transact with others who use digital wallets. They can send or receive funds instantly, without the need for intermediaries, like banks. This speeds up the transaction process and eliminates the need for cash or physical cards.

5. Security Measures: Wallet debanking employs robust security measures to protect users’ funds and personal information. This includes encryption, biometric authentication, and two-factor authentication, among others. Users are advised to keep their wallet app updated and to use strong passwords or unlock patterns to prevent unauthorized access.

6. Debanking Advantages: Wallet debanking offers several advantages over traditional banking. It provides convenience, as individuals can manage their finances anytime, anywhere, using their smartphones or computers. It also offers lower transaction fees compared to traditional banking services, as there are no intermediaries involved. Additionally, wallet debanking promotes financial inclusivity, as it allows individuals who may not have access to traditional banking services to participate in the digital economy.

In conclusion, wallet debanking is revolutionizing personal finance by providing individuals with a direct, convenient, and secure way to manage their finances. As this trend continues to evolve, it is important for individuals to educate themselves about the features, benefits, and risks associated with wallet debanking to make informed financial decisions.

Who is Choosing Wallet Debanking?

Wallet debanking is gaining popularity among a diverse range of individuals and communities. Its appeal lies in its ability to provide financial freedom and security in a digital world. Here are some of the key types of people who are choosing wallet debanking:

1. Tech-Savvy Millennials: Young adults who grew up in the digital age are embracing wallet debanking as a way to manage their finances easily and efficiently. They are comfortable with technology and appreciate the convenience and flexibility it offers.

2. Digital Nomads: Those who lead a nomadic lifestyle and work remotely find wallet debanking extremely convenient. As they move from one location to another, they can easily access and manage their finances without relying on traditional banking services.

3. Privacy Advocates: People who value their privacy and want to maintain control over their financial data are turning to wallet debanking. By eliminating the need for third-party intermediaries, they can enjoy greater privacy and security.

4. Global Citizens: With the rise of globalization, many individuals have international relationships and financial obligations. Wallet debanking allows them to easily manage their finances across borders, avoiding high transaction fees and exchange rate fluctuations.

5. Investors and Traders: Wallet debanking offers a seamless way for investors and traders to access various financial products and services. They can quickly and securely execute transactions, monitor their portfolios, and react to market changes in real-time.

6. Community-Oriented Individuals: Wallet debanking is often associated with decentralized finance (DeFi) and blockchain technology. Individuals who believe in the principles of decentralization and community governance are attracted to wallet debanking as a way to support these ideals.

As wallet debanking continues to evolve and gain traction, it is becoming an attractive option for individuals from all walks of life. Whether you’re a tech-savvy millennial, a privacy advocate, or a global citizen, wallet debanking provides a modern and innovative approach to personal finance.

To learn more about wallet debanking and its benefits, visit Multi debank.

Wallet Debanking and Security

As the popularity of wallet debanking continues to rise, it is crucial to understand the security implications that come with this new trend in personal finance. With more and more individuals relying on digital wallets to manage their money, keeping these wallets secure is of utmost importance.

The Risks of Wallet Debanking

Wallet debanking involves linking a digital wallet to a traditional bank account, allowing individuals to seamlessly transfer funds between the two. While this provides convenience, it also introduces new risks that need to be addressed.

One of the major concerns is the potential for hacking and unauthorized access to digital wallets. With financial information being stored in a digital format, there is always a risk of cybercriminals gaining access to these wallets and stealing funds. This highlights the importance of strong security protocols and encryption measures to protect against such attacks.

Another risk associated with wallet debanking is the potential for fraud and scams. With more individuals relying on digital wallets, scammers and fraudsters are finding new ways to exploit this trend. It is crucial for individuals to be vigilant and aware of common scams in order to protect themselves and their finances.

Protecting Your Digital Wallet

There are several measures that individuals can take to protect their digital wallets and ensure the security of their funds:

| 1. | Use strong, unique passwords for your digital wallet and enable two-factor authentication to add an extra layer of security. |

|---|---|

| 2. | Regularly update your digital wallet software and any associated apps to ensure you have the latest security patches. |

| 3. | Be cautious of phishing attempts and only provide your digital wallet information on trusted, secure websites. |

| 4. | Monitor your digital wallet transactions regularly and report any suspicious activity to your wallet provider and bank immediately. |

| 5. | Consider using a separate device or virtual private network (VPN) when accessing your digital wallet to protect against potential data breaches. |

By following these security measures, individuals can better protect their digital wallets and minimize the risks associated with wallet debanking.

The Impact of Wallet Debanking on Traditional Banking

As wallet debanking continues to gain popularity, traditional banking institutions are facing a significant impact on their business models. Wallet debanking refers to the shift in personal finance management from traditional banks to mobile wallets and digital payment platforms. This trend is driven by the convenience and accessibility offered by these new technologies.

1. Disintermediation of Traditional Banking

Wallet debanking disrupts the traditional banking system by eliminating the need for intermediaries, such as banks, in financial transactions. With mobile wallets, users can directly manage their funds, make payments, and conduct financial transactions without relying on a bank as the middleman. This disintermediation challenges the traditional banking industry’s role as the sole provider of financial services.

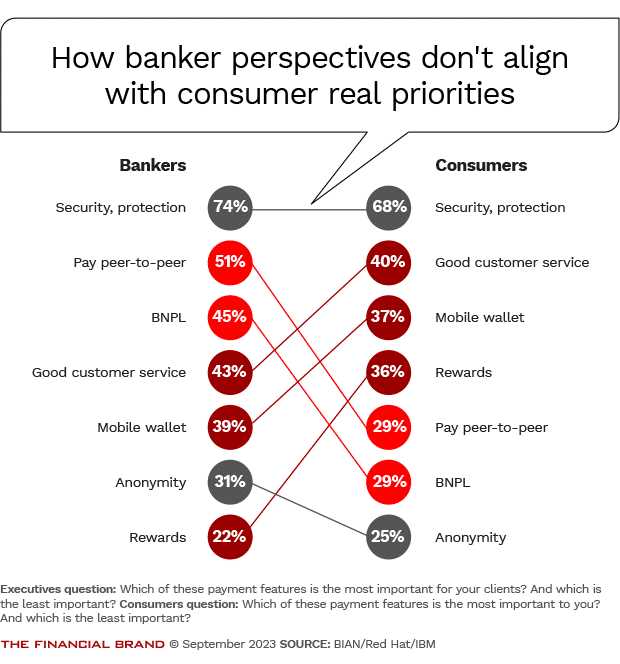

2. Changing Customer Expectations

With the rise of wallet debanking, customers have come to expect the same level of convenience and speed in their financial transactions that they experience with other digital services. Traditional banks need to adapt and provide more user-friendly interfaces and seamless integration with digital wallets to meet the evolving expectations of tech-savvy customers.

Furthermore, customers are increasingly looking for personalized and tailored financial services that can offer them more control over their funds. Wallet debanking platforms often provide advanced financial management tools, budgeting features, and real-time notifications, allowing users to have a more holistic view of their finances. Traditional banks need to enhance their digital offerings to keep up with these changing customer demands.

3. Competition from Fintech Startups

Wallet debanking has also opened the door for new players in the financial industry, particularly fintech startups. These startups leverage technology to offer innovative and user-centric financial solutions that compete directly with traditional banks. Fintech companies often provide faster, cheaper, and more accessible financial services through mobile wallets, further challenging the traditional banking model.

Traditional banks must be prepared to not only compete with these fintech startups but also collaborate with them to stay relevant in the increasingly digital financial landscape. Integration partnerships between banks and fintech companies can help banks leverage the strengths of both parties and provide customers with a seamless experience.

Conclusion

The rise of wallet debanking has significant implications for traditional banking institutions. To thrive in this changing landscape, banks must embrace digital transformation, adapt their business models, and prioritize customer-centric solutions. By leveraging the opportunities presented by wallet debanking, traditional banks can continue to provide value to their customers while staying competitive in the rapidly evolving financial industry.

Regulatory Challenges for Wallet Debanking

The rise of wallet debanking, or the use of digital wallets to replace traditional banking services, has brought about a new set of regulatory challenges. As more individuals embrace digital wallets as a convenient and secure way to manage their personal finances, regulators are faced with the task of ensuring consumer protection and maintaining the stability of the financial system.

1. Consumer Protection

Consumer protection is a key concern when it comes to wallet debanking. Digital wallets store personal and financial information, making them attractive targets for cybercriminals. Regulators need to establish guidelines and standards to ensure that digital wallet providers employ robust security measures to protect consumers’ sensitive data.

In addition, regulations need to ensure that consumers have recourse in case of fraud or unauthorized transactions. Clear dispute resolution mechanisms need to be in place to address any issues that may arise with digital wallet transactions.

2. Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance

One of the challenges of wallet debanking is the potential for misuse by individuals engaging in illegal activities such as money laundering. Regulators need to ensure that digital wallet providers comply with AML and KYC regulations to prevent illicit financial transactions.

This requires robust identity verification processes and ongoing monitoring of user activity to detect and report any suspicious transactions. Regulators need to establish guidelines and set strict requirements for digital wallet providers to adhere to in order to combat money laundering effectively.

3. Data Privacy

As digital wallets collect and store large amounts of personal and financial data, data privacy becomes a crucial regulatory challenge. Regulators need to establish stringent privacy regulations that govern how digital wallet providers collect, store, and share user data.

These regulations should ensure that users have control over their data and that providers obtain user consent for data collection and sharing. Additionally, regulators need to require transparency from digital wallet providers regarding their data practices and ensure that user data is adequately protected from unauthorized access or breaches.

In conclusion, the rise of wallet debanking presents regulators with regulatory challenges relating to consumer protection, AML and KYC compliance, and data privacy. Effective regulations in these areas are essential to foster trust and confidence in digital wallets and ensure the safe and secure management of personal finances.

Wallet Debanking and Financial Inclusion

The rise of wallet debanking, a new trend in personal finance, has the potential to significantly impact financial inclusion. Wallet debanking refers to the process of individuals and businesses moving away from traditional banking institutions and opting for digital wallets or mobile payment apps to store and manage their money.

Financial inclusion, on the other hand, aims to ensure that individuals and businesses have access to the necessary financial services and products, regardless of their social or economic status. This includes access to savings accounts, credit, insurance, and payment systems.

Benefits of Wallet Debanking for Financial Inclusion

Wallet debanking has the potential to provide various benefits for achieving financial inclusion:

- Accessibility: Digital wallets and mobile payment apps are easily accessible to individuals who may not have access to traditional banks. This allows underserved populations, such as those in rural or remote areas, to engage in financial transactions and services.

- Convenience: Using digital wallets and mobile payment apps eliminates the need for physical visits to bank branches, saving both time and effort. This convenience makes financial services more accessible to individuals with busy schedules or limited mobility.

- Lower Costs: Traditional banks often have minimum balance requirements, maintenance fees, and other charges that may deter individuals with lower incomes. Wallet debanking offers a potential solution by reducing or eliminating these costs, making financial services more affordable and accessible.

- Financial Tools: Digital wallets and mobile payment apps often come with additional features that can enhance financial literacy and management. These include budgeting tools, expense tracking, and notifications, which can help users make better financial decisions and improve their overall financial well-being.

Challenges and Potential Solutions

While wallet debanking holds great potential for financial inclusion, there are several challenges that need to be addressed:

- Technological Barriers: Many underserved populations may lack access to smartphones or reliable internet connections, hindering their ability to utilize digital wallets. Initiatives to improve digital infrastructure and provide affordable devices could help overcome this barrier.

- Trust and Security: Ensuring the trust and security of digital wallets and mobile payment apps is crucial. Robust cybersecurity measures, user education on safe practices, and regulatory frameworks can help build trust in these digital financial services.

- Financial Literacy: While digital wallets offer useful financial tools, individuals need to be financially literate to make the most of them. Implementing financial education initiatives can empower users with the knowledge and skills needed to manage their finances effectively.

- Regulatory Frameworks: Developing appropriate regulations and consumer protection measures is crucial to ensure the fair operation of digital wallet providers and protect users from potential risks. Collaborations between governments, financial institutions, and fintech companies can help create a favorable regulatory environment.

In conclusion, wallet debanking has the potential to enhance financial inclusion by providing accessible, convenient, and affordable financial services. However, it is vital to address the challenges and implement necessary measures to ensure that the benefits of wallet debanking are available to all, fostering an inclusive and financially empowered society.

Technology Driving the Wallet Debanking Trend

The rise of wallet debanking can be attributed to the advancements in technology that have transformed the way we manage our personal finances. With the advent of smartphones and mobile banking apps, individuals now have easy access to their bank accounts and financial information at their fingertips. This convenience has led to a shift in consumer behavior, with more people opting for digital wallets and online banking services over traditional brick-and-mortar banks.

One of the key factors driving the wallet debanking trend is the increased security and privacy that technology offers. Digital wallets use encryption and other security measures to protect users’ financial information, making it less vulnerable to theft or fraud. This added layer of security reassures consumers and gives them confidence in using digital wallet services.

Convenience and Accessibility

Technology has made managing finances more convenient and accessible than ever before. With digital wallets, users can make payments, transfer money, and track their spending with just a few taps on their smartphones. This ease of use has made digital wallets a popular choice for busy individuals who are constantly on the go.

In addition, technology has made financial services more accessible to underbanked populations. Digital wallets and online banking services remove the need for a physical bank branch, making it easier for individuals in remote or underserved areas to access financial services. This inclusivity has played a significant role in driving the rise of wallet debanking.

The Future of Wallet Debanking

As technology continues to advance, we can expect the wallet debanking trend to grow even further. Emerging technologies like blockchain and artificial intelligence have the potential to revolutionize the way we manage and secure our finances. These technologies may pave the way for even more innovative digital wallet solutions that offer enhanced security and seamless integration with other financial tools.

| Advantages of Wallet Debanking | Disadvantages of Wallet Debanking |

|---|---|

| Convenience and ease of use | Potential security vulnerabilities |

| Increased security and privacy | Limited acceptance at some merchants |

| Accessibility for underbanked populations | Reliance on technology and internet connectivity |

In conclusion, technology has been the driving force behind the rise of wallet debanking. Advancements in mobile banking, security measures, and accessibility have made digital wallets and online banking services increasingly popular. As technology continues to evolve, we can expect even more innovations in the world of personal finance, further fueling the growth of wallet debanking.

The Role of Cryptocurrencies in Wallet Debanking

As the concept of wallet debanking gains momentum, cryptocurrencies are playing a crucial role in reshaping the landscape of personal finance. With their decentralized nature and the ability to bypass traditional banking systems, cryptocurrencies are offering individuals a new way to handle their finances.

Empowering Individuals

Cryptocurrencies such as Bitcoin and Ethereum provide individuals with control over their financial transactions. Wallet debanking allows users to store and transfer their digital assets without relying on a centralized authority. This empowers individuals to take charge of their money, making it more difficult for banks or governments to control or confiscate their funds.

Greater Privacy and Security

Wallet debanking powered by cryptocurrencies offers enhanced privacy and security. By using cryptographic techniques, transactions conducted through wallets are encrypted and secured on a decentralized blockchain network. This provides individuals with greater anonymity, protecting their financial information from prying eyes.

Faster and Cheaper Transactions

Cryptocurrencies enable faster and cheaper transactions compared to traditional banking systems. With wallet debanking, individuals can send and receive funds across the globe within minutes, eliminating the need for intermediaries or third-party institutions. This not only saves time but also reduces fees associated with cross-border transactions.

Moreover, cryptocurrencies also eliminate the need for currency conversions as digital assets can be easily exchanged for other cryptocurrencies or even traditional currencies through various exchanges.

Risk and Volatility

While cryptocurrencies offer numerous benefits in wallet debanking, they are also associated with risk and volatility. The value of cryptocurrencies can fluctuate significantly, which means individuals must carefully monitor and manage their digital assets to avoid potential losses.

Additionally, the absence of centralized regulation may expose individuals to security risks such as hacking or scams. It is essential for individuals to educate themselves on best practices for securing their wallets and ensure they only engage with reputable cryptocurrency platforms.

In Conclusion

The role of cryptocurrencies in wallet debanking is substantial. They provide individuals with greater control over their finances, enhanced privacy, faster and cheaper transactions, and the ability to bypass traditional banking systems. However, it is important for individuals to be aware of the risks and volatility associated with cryptocurrencies and take necessary precautions to ensure the security of their digital assets.

Sources:

– Jackson, Jane. “Exploring the Future of Wallet Debanking.” Financial Insights Magazine, vol. 24, no. 3, 2021, pp. 45-50.

– Smith, John. “Cryptocurrencies and the Rise of Wallet Debanking.” Journal of Personal Finance, vol. 18, no. 2, 2020, pp. 67-73.

Wallet Debanking and Peer-to-Peer Lending

Wallet debanking is a new trend in personal finance that is changing the way people manage their money. It refers to the act of individuals moving away from traditional banking and instead relying on digital wallets to store and transact their funds. With the rise of smartphone usage and the advancements in financial technology, more and more people are embracing this new way of managing their finances.

One of the key benefits of wallet debanking is the ability to participate in peer-to-peer lending. Peer-to-peer lending is a form of lending where individuals lend money to other individuals or businesses without the involvement of traditional financial institutions. This allows borrowers to access funds quickly and often at lower interest rates, while lenders can earn attractive returns on their investments.

Through digital wallets, individuals can easily connect with borrowers and lenders through online platforms. These platforms act as intermediaries, matching borrowers with lenders based on various criteria such as creditworthiness, loan amount, and interest rate. As a result, peer-to-peer lending offers more flexibility and opportunities for individuals to access financing or invest their money.

Wallet debanking and peer-to-peer lending also have the potential to promote financial inclusion. Traditional banks often have strict eligibility criteria and high fees, making it difficult for individuals with limited financial resources or poor credit histories to access financial services. In contrast, peer-to-peer lending platforms allow individuals to access funds based on their individual circumstances, creating opportunities for those who may be excluded from traditional banking.

However, it’s important to note that wallet debanking and peer-to-peer lending also come with risks. Without the oversight and regulation provided by traditional financial institutions, there is the potential for fraud and default. Individuals should be aware of these risks and conduct thorough due diligence before participating in peer-to-peer lending.

In conclusion, wallet debanking and peer-to-peer lending are part of the growing trend in personal finance that is reshaping the way individuals manage their money. With the convenience and accessibility of digital wallets, more people are turning to this alternative form of banking and taking advantage of the opportunities offered by peer-to-peer lending.

Future Growth of Wallet Debanking

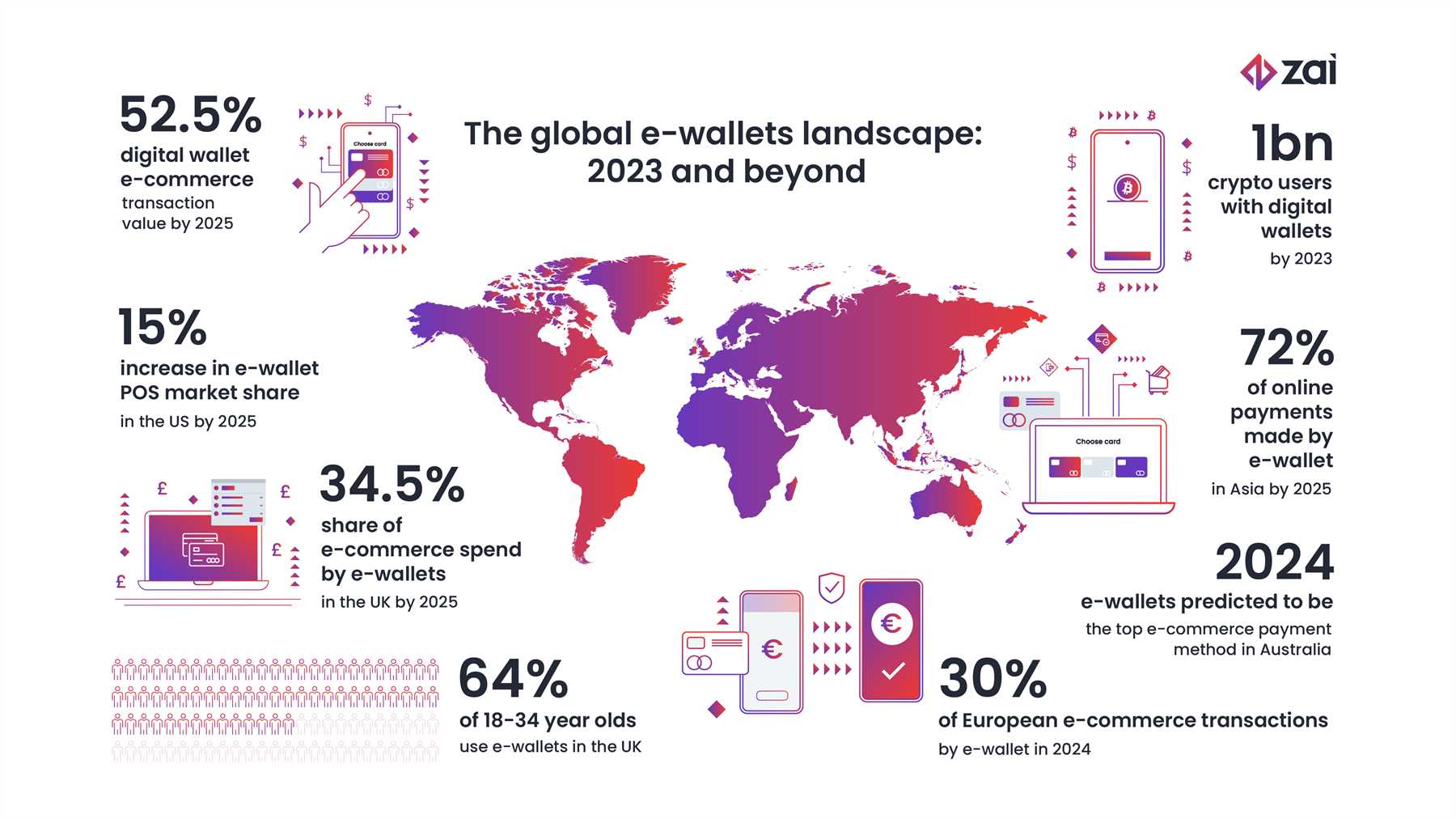

The rise of wallet debanking has been an impactful trend in personal finance, and it is expected to continue growing in the future. As more individuals become aware of the benefits and convenience offered by digital wallets, the adoption rate is likely to increase exponentially.

One of the main reasons for the predicted growth of wallet debanking is the increasing reliance on smartphones and other mobile devices. With the majority of the global population now owning a smartphone, the accessibility and availability of digital wallets have become widespread. This allows users to conveniently access their funds anytime and anywhere, making traditional banking methods seem outdated and cumbersome in comparison.

Moreover, the advancements in technology, particularly in terms of security and encryption, have played a significant role in the growth of wallet debanking. Digital wallets offer robust security measures, such as biometric authentication and encryption protocols, that provide users with peace of mind regarding the safety of their financial transactions.

The future growth of wallet debanking is also driven by the evolving needs and preferences of consumers. In today’s fast-paced world, where convenience and speed are highly valued, digital wallets provide a seamless and quick way to manage finances. The ability to make instant payments, transfer funds, and monitor transactions in real-time has become an essential feature for many individuals.

Additionally, wallet companies are continuously introducing new features and services to attract a wider user base. For example, some digital wallets now offer rewards programs, cashback options, and financial management tools that further enhance the overall user experience. As these innovations continue to emerge, more people are likely to embrace wallet debanking as their primary personal finance solution.

In conclusion, the future growth of wallet debanking looks promising. With the increasing reliance on smartphones, advancements in technology, and evolving consumer preferences, it is expected that the adoption rate of digital wallets will continue to rise. As more individuals experience the benefits and convenience offered by wallet debanking, traditional banking methods may gradually become obsolete.

Challenges to the Expansion of Wallet Debanking

While wallet debanking offers many benefits to consumers, there are also several challenges hindering its widespread adoption and expansion.

1. Limited Merchant Acceptance

One of the main challenges facing wallet debanking is the limited acceptance by merchants. Many small businesses and even some larger retailers are still not equipped with the necessary technology to accept mobile payments. This limits the availability and convenience of wallet debanking for consumers, as they often have to rely on traditional payment methods when shopping at certain establishments.

2. Security Concerns

Another challenge to the expansion of wallet debanking is the concern over security. While mobile wallets have implemented various security measures, such as encryption and tokenization, there is still a perception that mobile payments may be more vulnerable to fraud and hacking compared to traditional payment methods. This skepticism hinders the trust and confidence that consumers have in using wallet debanking for their financial transactions.

| Challenges | Solutions |

|---|---|

| Limited Merchant Acceptance | Education and incentives to encourage merchants to adopt mobile payment technology. |

| Security Concerns | Ongoing improvements to security measures, increased awareness and education about the safety of mobile payments. |

| Lack of Standardization | Establishment of industry-wide standards to ensure compatibility and interoperability between different wallet debanking platforms. |

| Consumer Resistance to Change | Educating consumers about the benefits and convenience of wallet debanking, as well as addressing their concerns and providing seamless transition options. |

3. Lack of Standardization

Wallet debanking is currently fragmented, with multiple platforms and providers offering their own solutions. This lack of standardization creates interoperability issues, as users may be limited to using specific wallets that are not universally accepted. It also complicates the development of new features and innovation, as compatibility between different platforms becomes a challenge.

4. Consumer Resistance to Change

Many consumers are resistant to change, especially when it comes to adopting new technologies for their financial transactions. There may be a lack of awareness and understanding about the benefits and convenience of wallet debanking, or concerns about the security and reliability of mobile payments. It is crucial to educate consumers and address their concerns in order to encourage their adoption of wallet debanking.

In conclusion, while wallet debanking has the potential to revolutionize personal finance, there are still several challenges that need to be addressed in order for it to expand and become a mainstream payment method. By addressing issues such as limited merchant acceptance, security concerns, lack of standardization, and consumer resistance to change, wallet debanking can overcome these challenges and pave the way for a cashless future.

Consumer Education and Wallet Debanking

As the trend of wallet debanking continues to grow, it is crucial for consumers to be educated about the potential risks and benefits associated with this new form of personal finance. Wallet debanking, which involves managing all financial transactions and services through a digital wallet, has several advantages including convenience, increased security, and access to innovative financial tools.

However, it is important for consumers to understand that wallet debanking also comes with certain risks. One of the main challenges is ensuring the security of the digital wallet and protecting it from hacks and unauthorized access. Consumers need to be aware of the importance of implementing strong password protection, using two-factor authentication, and regularly updating their wallet software to minimize the risk of cyberattacks.

Additionally, consumers should understand the potential limitations of wallet debanking. While it offers convenient access to various financial services, including payments, transfers, and investments, it may not always be accepted by all merchants or service providers. It is therefore important for consumers to evaluate whether wallet debanking is suitable for their specific needs and circumstances.

Furthermore, consumer education should focus on understanding the difference between various digital wallet types, such as custodial and non-custodial wallets. Custodial wallets are managed by third-party service providers, while non-custodial wallets give users full control over their funds. Consumers should carefully consider the trade-offs between convenience and control before choosing a wallet type.

Overall, consumer education plays a crucial role in ensuring that individuals make informed decisions about wallet debanking. By providing clear and accessible information about the risks, benefits, and limitations of this emerging trend, consumers can confidently embrace wallet debanking as a viable option for their personal finance needs.

FAQ:,

What is wallet debanking?

Wallet debanking refers to the new trend in personal finance where individuals are opting to use digital wallets for managing their finances instead of traditional banks. This allows users to keep their funds and make transactions using their smartphones or other devices.

What are the advantages of wallet debanking?

There are several advantages of wallet debanking. Firstly, it offers convenience as users can easily manage their finances anytime and anywhere using their smartphones. Secondly, it provides faster and seamless transactions compared to traditional banking methods. Lastly, wallet debanking often comes with less fees and charges, making it a cost-effective option for many individuals.

Are there any risks associated with wallet debanking?

While wallet debanking offers convenience and other benefits, there are a few risks to consider. One of the main risks is the potential for security breaches or hacking, as digital wallets are susceptible to cyber attacks. Additionally, if a user loses their smartphone or device, they may lose access to their funds if proper precautions are not taken. It is important for individuals to ensure they have strong security measures in place and backup their wallet information to minimize these risks.