Ensuring Safer and More Secure Transactions with Debank

In today’s digital world, online transactions have become the norm. From purchasing products to transferring money, we rely on technology to make our lives easier. However, with the increase in online transactions, the risk of fraud and cybersecurity threats has also grown exponentially. That’s where Debank comes in.

Debank is revolutionizing the way we conduct online transactions by providing a safer and more secure platform. With its advanced encryption technology, Debank ensures that your personal information and financial data are securely protected. This means that you can make transactions with peace of mind, knowing that your sensitive information is safe from prying eyes.

One of the key features of Debank is its robust fraud detection system. Through machine learning algorithms and artificial intelligence, Debank analyzes transaction patterns and detects any suspicious activity. This proactive approach helps prevent fraudulent transactions before they occur, saving you from potential financial loss and identity theft.

Furthermore, Debank offers multi-factor authentication to add an extra layer of security to your transactions. By requiring more than just a password, Debank ensures that only authorized individuals can access your account. Whether it’s through fingerprint recognition or one-time verification codes, Debank prioritizes your security without compromising convenience.

In conclusion, Debank is dedicated to ensuring safer and more secure transactions in our increasingly digital world. With its advanced encryption, fraud detection capabilities, and multi-factor authentication, Debank provides you with the peace of mind you need when conducting online transactions. Say goodbye to worries about fraud and cybersecurity threats–Debank has you covered.

The Importance of Secure Transactions

Secure transactions are paramount in today’s digital age. With the increasing prevalence of online shopping, e-commerce platforms, and digital payments, ensuring the security of transactions has become a crucial aspect of maintaining trust and protecting sensitive information.

One of the primary concerns when it comes to transactions is the protection of personal and financial data. Whether it’s credit card information, bank account details, or personal identification, unauthorized access to this data can result in identity theft, fraud, and significant financial losses.

By implementing robust security measures, platforms like Debank are working to safeguard transactions and provide users with peace of mind. Advanced encryption techniques and secure protocols are utilized to protect data during transmission and storage.

In addition to data security, secure transactions also involve verifying the authenticity of the parties involved and ensuring that the transaction itself is legitimate. This helps prevent unauthorized access, spoofing, and phishing attacks.

Building Trust and Confidence

Secure transactions are essential for building trust and confidence among users. When individuals have the assurance that their personal information and financial transactions are protected, they are more likely to engage in online activities.

By prioritizing security, companies like Debank are taking proactive steps to foster a safe and trusted environment for users. This, in turn, can lead to increased customer satisfaction, loyalty, and ultimately, business growth.

Protecting Financial Institutions

Secure transactions are not only crucial for individuals but also for financial institutions. Banks and other financial entities rely on secure transactions to protect their own systems and infrastructure from cyber threats.

By partnering with secure transaction platforms like Debank, financial institutions can enhance their own security measures and mitigate the risk of data breaches and other attacks. This helps maintain the integrity of their operations and prevents potential reputational damage.

In conclusion, secure transactions play a vital role in the digital landscape. With the ever-increasing reliance on digital transactions, ensuring the security and protection of sensitive information is essential. Platforms like Debank are at the forefront of this effort, working tirelessly to provide users with secure and trusted transactional experiences.

Debank: A Leading Authority in Transaction Security

Debank is at the forefront of ensuring safer and more secure transactions in the digital landscape. As a leading authority in transaction security, Debank employs cutting-edge technologies and innovative strategies to protect users’ funds and personal information.

One of the key aspects of Debank’s approach to transaction security is its advanced encryption methods. All transactions carried out on the platform are encrypted using state-of-the-art cryptographic algorithms, ensuring that sensitive information remains private and secure.

In addition to encryption, Debank implements multi-factor authentication protocols to further enhance security. Users are required to go through a rigorous verification process, which may include biometric authentication or the use of hardware security keys. This multi-layered approach significantly reduces the risk of unauthorized access to user accounts.

Debank also keeps a constant watch on the latest security threats and vulnerabilities that may arise in the digital world. By staying up-to-date with security trends and implementing proactive measures, Debank is able to swiftly identify and neutralize potential risks, ensuring the safety of user funds and data.

Furthermore, Debank regularly conducts comprehensive security audits and penetration tests to identify any weaknesses in its systems. This meticulous approach allows Debank to proactively address any vulnerabilities, providing users with peace of mind knowing that their transactions are taking place in a secure environment.

| Debank’s Transaction Security Measures: |

|---|

| Advanced encryption methods |

| Multi-factor authentication protocols |

| Ongoing monitoring of security threats |

| Regular security audits and penetration tests |

Debank’s commitment to transaction security has earned it a reputation as a trusted platform in the industry. Users can rely on Debank to provide a secure environment for their transactions, ensuring that their funds and personal information are protected at all times.

Ensuring Safe Transactions with Advanced Encryption

In order to provide a secure and reliable platform for transactions, Debank utilizes advanced encryption technologies. This ensures that all sensitive financial information is protected and inaccessible to unauthorized individuals.

The encryption methods employed by Debank exceed industry standards and are constantly updated to stay ahead of potential threats. By encrypting data at rest and in transit, Debank ensures that user information remains secure throughout the entire transaction process.

Debank’s commitment to security extends beyond encryption. The platform also implements multi-factor authentication, requiring users to provide additional verification steps before accessing their accounts. This adds an extra layer of protection to ensure that only authorized individuals can complete transactions.

Furthermore, Debank regularly conducts security audits and assessments to identify and address any vulnerabilities in the system. This proactive approach allows for timely detection and resolution of potential security risks, further safeguarding user transactions.

With Debank’s robust security measures in place, users can have peace of mind knowing that their transactions are protected from fraudulent activities. To learn more about how Debank ensures safe transactions, visit How do debank.

Debank’s Cutting-Edge Authentication Methods

Debank is committed to ensuring safer and more secure transactions for its users. One of the ways it achieves this is through its cutting-edge authentication methods.

Debank utilizes advanced biometric authentication techniques, such as fingerprint and facial recognition, to verify the identity of users. These methods provide a higher level of security than traditional password-based authentication.

In addition to biometric authentication, Debank also employs multi-factor authentication (MFA) to further enhance security. MFA requires users to verify their identity using multiple factors, such as a password, a fingerprint scan, and a one-time code sent to their registered mobile device. This layered approach makes it significantly more difficult for unauthorized individuals to gain access to user accounts.

Furthermore, Debank employs state-of-the-art encryption algorithms to protect sensitive user data during transmission and storage. This ensures that even if intercepted, the data would be virtually impossible to decipher.

Debank’s commitment to staying at the forefront of authentication technology means that users can have peace of mind, knowing that their transactions are being conducted in the most secure manner possible.

The Role of Biometrics in Transaction Security

With the increasing prevalence of digital transactions, ensuring security has become a top priority for financial institutions. One of the most effective tools in this regard is the use of biometrics, which offers a unique and secure way to authenticate transactions.

Enhanced Authentication

Biometrics, such as fingerprint or facial recognition, provide a higher level of authentication compared to traditional methods like passwords or PINs. This is because biometric data is unique to each individual and cannot be easily replicated or stolen.

By using biometric authentication, financial institutions can ensure that only authorized individuals can access and initiate transactions. This helps prevent fraud and unauthorized access, making transactions more secure.

Improved User Experience

In addition to enhanced security, biometrics also offer a more seamless and convenient user experience. With biometric authentication, users no longer need to remember complex passwords or carry physical tokens like key fobs.

Transactions can be securely authorized with a simple fingerprint scan or a quick face recognition, reducing friction and making the overall transaction process faster and more convenient for customers.

Furthermore, biometrics can also add an extra layer of security in case of lost or stolen devices. Even if a device is compromised, the biometric data required for authentication cannot be easily replicated.

Financial institutions can leverage biometrics to build trust and confidence among their customers while providing them with a secure and user-friendly way to engage in transactions.

Future Potential

As technology continues to advance, the role of biometrics in transaction security is expected to expand further. Biometrics can be integrated with other security measures, such as behavioral analysis or voice recognition, to create a comprehensive and multi-factor authentication system.

Moreover, biometrics can also be used for continuous authentication, where a user’s identity is constantly verified throughout the transaction process. This can help detect and prevent any suspicious activity in real-time, further enhancing security.

Overall, biometrics have the potential to revolutionize transaction security by offering a highly secure, convenient, and user-friendly way to authenticate transactions. With ongoing advancements, biometrics will likely become an integral part of securing digital transactions in the future.

Protecting Against Fraudulent Activities

At Debank, we understand the importance of protecting our users and their transactions from fraudulent activities. We have implemented several measures to ensure the security of your account and the safety of your funds.

Secure Authentication

One of the key ways we protect against fraudulent activities is by ensuring secure authentication. When you sign up for a Debank account, we require you to create a strong password and enable two-factor authentication (2FA). This adds an extra layer of security to your account and helps prevent unauthorized access.

Advanced Monitoring Systems

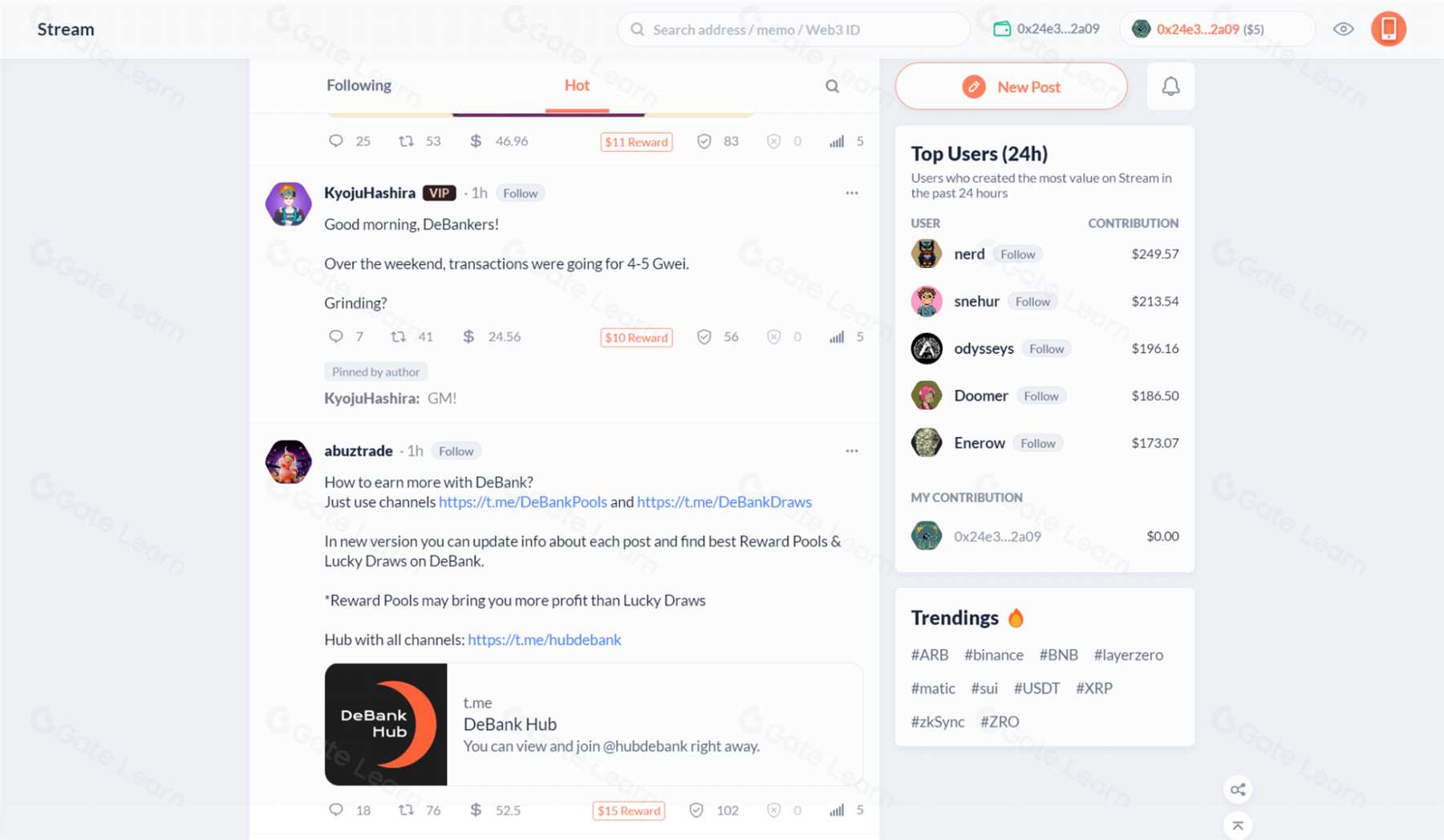

We have implemented advanced monitoring systems that continuously analyze user activity to detect any suspicious patterns or behaviors. These systems help us identify and prevent fraudulent transactions in real-time, keeping your funds safe and secure.

Additionally, we utilize machine learning algorithms to constantly improve our monitoring systems and stay ahead of evolving fraud techniques.

Encryption and Data Protection

Debank prioritizes the protection of your personal and financial information. Your data is encrypted using advanced cryptographic algorithms to prevent unauthorized access. We also comply with strict data protection regulations to ensure the confidentiality and integrity of your information.

Regular Security Audits

We conduct regular security audits to assess and strengthen our systems against potential vulnerabilities. This helps us identify any weak points in our infrastructure and take necessary steps to eliminate them. Our goal is to maintain a secure platform that you can trust for your transactions.

By implementing these measures, Debank is committed to providing a safer and more secure environment for your transactions, protecting you against fraudulent activities in the ever-evolving digital landscape.

Real-Time Monitoring for Enhanced Security

Debank understands the importance of ensuring the security of transactions, which is why they employ real-time monitoring systems. These systems allow them to constantly monitor activities on their platform and detect any suspicious or fraudulent behavior.

By using advanced technology and algorithms, Debank is able to analyze and assess transaction patterns, identifying any anomalies or red flags. This allows them to take immediate action and prevent any potential security threats.

Additionally, Debank employs a team of security experts who are dedicated to monitoring and analyzing transaction data. These experts are experienced in identifying and mitigating security risks, ensuring that every transaction on the platform is secure.

Real-time monitoring not only enhances the security of transactions but also provides peace of mind to users. By being proactive and vigilant, Debank is able to stay one step ahead of potential security threats and ensure that their platform remains a safe and trusted place for all transactions.

Debank’s Partnerships: Strengthening Security Measures

Debank is committed to providing its users with the most advanced security measures to ensure safer and more secure transactions. One of the ways it achieves this is through strategic partnerships with industry-leading companies in the field of cybersecurity.

Partnership with Global Security Solutions

Debank has joined forces with Global Security Solutions, a renowned cybersecurity company, to enhance the security infrastructure of its platform. Through this partnership, Debank benefits from the expertise and advanced technologies provided by Global Security Solutions, which include intrusion detection systems, data encryption, and network security protocols. This collaboration ensures that Debank’s users’ data and transactions are protected from any potential threats.

Collaboration with Fraud Detection Experts

As a part of its commitment to combat fraud, Debank has partnered with leading fraud detection experts. By leveraging their advanced algorithms and machine learning capabilities, Debank is able to detect and prevent fraudulent activities in real-time. This collaboration enables Debank’s users to have peace of mind knowing that their transactions are being closely monitored and any suspicious activities are immediately flagged.

| Benefits of Debank’s Partnerships: |

|---|

| Enhanced security infrastructure |

| Intrusion detection systems |

| Data encryption |

| Network security protocols |

| Real-time fraud detection |

The Future of Transaction Security with Debank

As technology continues to advance, so does the need for more secure and reliable methods of conducting transactions. Debank is at the forefront of this movement, developing innovative solutions to ensure the safety and security of every transaction.

Enhanced Encryption

One of the key pillars of transaction security is encryption. Debank is leveraging the latest encryption technologies to provide end-to-end encryption for all transactions. This means that the data exchanged during a transaction is securely encrypted and can only be accessed by the intended recipient. This ensures that sensitive information such as personal and financial details are protected against unauthorized access.

Biometric Authentication

In addition to encryption, Debank is also exploring the use of biometric authentication for enhanced transaction security. Biometric data such as fingerprints or facial recognition can be used to verify the identity of the user, adding an extra layer of protection against identity theft and fraud. By incorporating biometric authentication, Debank aims to provide a seamless and secure user experience.

Furthermore, Debank is researching the use of advanced AI algorithms to detect and prevent fraudulent transactions in real-time. By analyzing patterns and behaviors, these algorithms can identify suspicious activities and flag them for further investigation, helping to protect users from financial loss.

Collaboration with Financial Institutions

Debank understands the importance of collaboration in achieving robust transaction security. That’s why they are actively partnering with financial institutions to implement comprehensive security measures. By working together, Debank and financial institutions can share best practices, knowledge, and resources to stay one step ahead of cybercriminals.

Overall, Debank is committed to developing and implementing cutting-edge security measures to ensure the future of transaction security. By leveraging encryption, biometric authentication, AI algorithms, and collaboration with financial institutions, Debank is setting the standard for safer and more secure transactions.

Leveraging Debank for Safer and More Secure Transactions

In an increasingly digital world, ensuring the safety and security of our online transactions is of paramount importance. This is where Debank comes in, offering a comprehensive solution to protect against fraud and provide peace of mind.

Secure Your Assets with Debank

Debank acts as a decentralized exchange aggregator, offering users a secure and streamlined platform to manage their digital assets. By leveraging the power of blockchain technology, Debank ensures that your assets are safe and protected at all times.

Through its advanced security protocols and encryption techniques, Debank safeguards your transactions and prevents unauthorized access to your funds. This includes secure wallet integration, multi-factor authentication, and real-time monitoring to detect any suspicious activities.

Verify and Validate Transactions

Debank provides users with the ability to verify and validate transactions in real-time, ensuring the authenticity and integrity of each transaction. This is achieved through its robust network of trusted validators, who verify the accuracy of the transaction details and ensure that they align with the user’s intentions.

By leveraging Debank’s verification system, users can have confidence that their transactions are legitimate and that they are not falling victim to any fraudulent activities. This added layer of security and trust is crucial in an era where cybercrime is constantly evolving.

Furthermore, Debank’s transaction validation process helps mitigate the risk of double-spending, ensuring that each transaction is unique and cannot be manipulated or duplicated.

In conclusion, Debank offers a comprehensive solution to ensure safer and more secure transactions in the digital realm. By leveraging its robust security protocols and verification processes, users can have peace of mind knowing that their assets are protected and their transactions are legitimate.

FAQ:,

What is Debank?

Debank is a platform that ensures safer and more secure transactions in the crypto space. It provides users with the ability to track their transactions and monitor the security measures of different platforms.

How does Debank ensure safer transactions?

Debank ensures safer transactions by allowing users to connect their wallets and track their transactions in real-time. It also provides information on the security measures implemented by different platforms, allowing users to make more informed decisions.

Why is it important to ensure secure transactions in the crypto space?

Ensuring secure transactions in the crypto space is important because the decentralized nature of cryptocurrencies makes them susceptible to hacking and other security threats. By ensuring secure transactions, users can protect their funds and have peace of mind while conducting transactions in the crypto space.

Can Debank be used for all types of cryptocurrencies?

Yes, Debank can be used for all types of cryptocurrencies. It supports a wide range of cryptocurrencies and provides users with the ability to track their transactions and monitor the security measures of different platforms for each supported cryptocurrency.